DataVision was founded in 1992 with the purpose of providing clients with customisable, scalable and affordable banking software products and solutions.

Uchil Heights, Jagdishnagar, Raj Bhavan Road, Aundh, Pune - 411007, Maharashtra, India

+91-20-25690661/2/3

info@datavsn.com

6 Key reasons why banks should migrate to cloud computing in 2022

The world is continuously changing and presenting people with several opportunities. Digitalization has affected virtually all industries. Big Data may store vast amounts of information and provide access to any desired source. Cloud computing has already transformed education, software development, and real estate, and banking is no exception.

Traditional methods of information storage are no longer helpful because their technology has become obsolete and offers fewer benefits. As a result, numerous banks are adapting their perspectives and attempting to keep up with technological advancements. Undoubtedly, cloud computing is one of them.

In banking services, cloud computing facilitates the management and analysis of any data. Furthermore, it is significantly safer, as banks want a sense of security. One benefit of cloud computing in the banking industry is the opportunity to save money. Since cloud-based services are always accessible and don’t require additional instruments, it is abundantly evident that they significantly improve a company’s job efficiency.

Let’s understand cloud computing in the banking business, why it is significant today, and the primary benefits of adopting cloud computing for banking services. It will also guide how to effectively employ cloud-based services to enhance the quality of your job.

The function of cloud computing in the financial sector

It is common knowledge that the banking industry requires precision and computation, which might take time. Big Data is indispensable in this field. Because automated processes boost efficiency and performance, they are crucial to the industry. However, this is not the only reason cloud computing’s significance is difficult to overstate.

Initially, cloud computing in banking enables banks to maintain direct consumer contact. With the aid of cloud-based services, you may manage various challenging situations regardless of the location of your users. Traditional storage does not always permit the storage of large volumes of data, making them unworkable and a source of many complications. In contrast, there are no such circumstances with the cloud. You can plan and administer your services without difficulty, as cloud computing activities are pretty efficient.

One of the main benefits of cloud computing in banking is reliability. It allows the bank to pay greater attention to the user. Cloud-based services organize all procedures and instil a sense of security in the customer. Additionally, the digitalization of the banking process is highly advantageous for the entire sector.

Overall, cloud computing’s impact on banking is substantial and unquestionably a driving force in the industry’s development in the modern day.

What are the most compelling arguments for utilizing cloud computing for banking services?

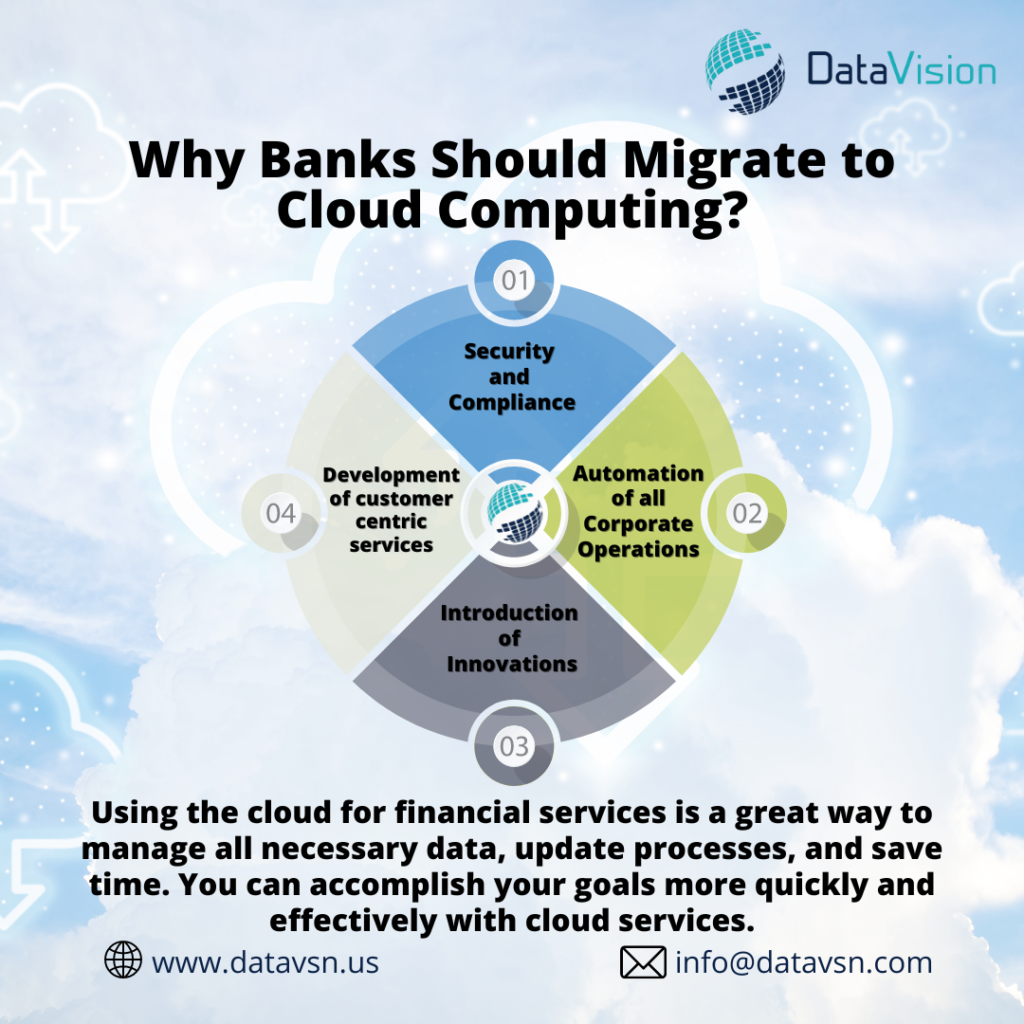

Adopting the cloud in banking services is an excellent approach to updating procedures, saving time, and managing all required data. With cloud services, you can achieve your objectives more quickly and efficiently. The following are significant reasons why banks utilize cloud computing.

Final Reflections

The significance of cloud computing in banking is immense. This method of storing data is highly prevalent today, as previous methods do not permanently preserve all data. A single source for all essential information is reasonably straightforward and gives security and accessibility. With cloud services, you may save on expenses and increase productivity.

Since everything is digital, it is evident that cloud computing is an absolute necessity. To remain competitive in the market, you must alter your perspective and broaden your experience, although some businesses still favour antiquated information management practices. It is essential to remain receptive to new technology, as the world is constantly changing. You may rest assured that as time passes, more and more technology will emerge to simplify your life and help you achieve your objectives with minimal difficulty.

Datavision actively utilizes cloud computing to develop financial products for clients. Priorities include:

All of these are additional advantages of cloud computing in banking. Datavision strives to keep up with the newest technologies to satisfy the business needs of its clients. Therefore, cloud computing is highly vital to our business.

How Can Datavision help?

On their digital transformation journey, we assist a variety of financial institutions and global banks. Our one-of-a-kind approach, which combines people, process and technology expedites the delivery of superior results to our clients and drives excellence. Several reputed companies leverage our proprietary suite of business excellence tools and services to unlock new growth levers and unparalleled ROI.

Datavision stands proudly as a prominent banking software solutions provider, recognized for our unwavering commitment to excellence in the industry. We have earned our esteemed reputation by consistently delivering cutting-edge core banking software, catering to the needs of both retail and corporate banking software sectors. At Datavision, our mission is clear: to provide our clients with the best banking software products, ensuring that they stay ahead in an ever-evolving financial landscape. We take pride in serving our prestigious clients and look forward to continuing our journey of innovation and excellence.

Get in touch with us for customizable, scalable, and affordable banking software products and solutions. Our portfolio of banking software product and services include:

Core Banking Solutions FinNext Core | FinNext Islamic Banking | FinTrade | EasyLoan | MicroFin

Digital Banking Solutions IBanc | MobiBanc | MBranch | FinTab | FinSight

Risk & Compliance FinTrust | InvestRite

Want to know how our team of experts at Datavision offer our reputed clients customisable, scalable and affordable banking software products and solutions? Visit us to know more.

The “ENGINE” Framework: Transforming Developers into Engineers

April 11, 2025

The “ENGINE” Framework: Transforming Developers into Engineers

April 11, 2025

Ensuring Compliance in Financial Software Development

March 31, 2025

Ensuring Compliance in Financial Software Development

March 31, 2025

The Role of Microservices in Modernizing Core Banking Systems

March 19, 2025

The Role of Microservices in Modernizing Core Banking Systems

March 19, 2025

How Blockchain is Impacting the Future of Banking

March 3, 2025

How Blockchain is Impacting the Future of Banking

March 3, 2025

Data Privacy in Financial Services: Best Practices and Strategies

February 14, 2025

Data Privacy in Financial Services: Best Practices and Strategies

February 14, 2025

Improving Trade Finance Operations through Technology

January 30, 2025

Improving Trade Finance Operations through Technology

January 30, 2025

The Future of Mobile Banking: Trends and Predictions

January 16, 2025

The Future of Mobile Banking: Trends and Predictions

January 16, 2025

A Guide to Effective API Management in Financial Services

December 31, 2024

A Guide to Effective API Management in Financial Services

December 31, 2024

Top Challenges in Developing Secure Fintech Applications

December 16, 2024

Top Challenges in Developing Secure Fintech Applications

December 16, 2024

Best Practices for Implementing EFT Switch Solutions

November 30, 2024

Best Practices for Implementing EFT Switch Solutions

November 30, 2024