DataVision was founded in 1992 with the purpose of providing clients with customisable, scalable and affordable banking software products and solutions.

Uchil Heights, Jagdishnagar, Raj Bhavan Road, Aundh, Pune - 411007, Maharashtra, India

+91-20-25690661/2/3

info@datavsn.com

The Role of Banks in the Transition to a Cashless Society

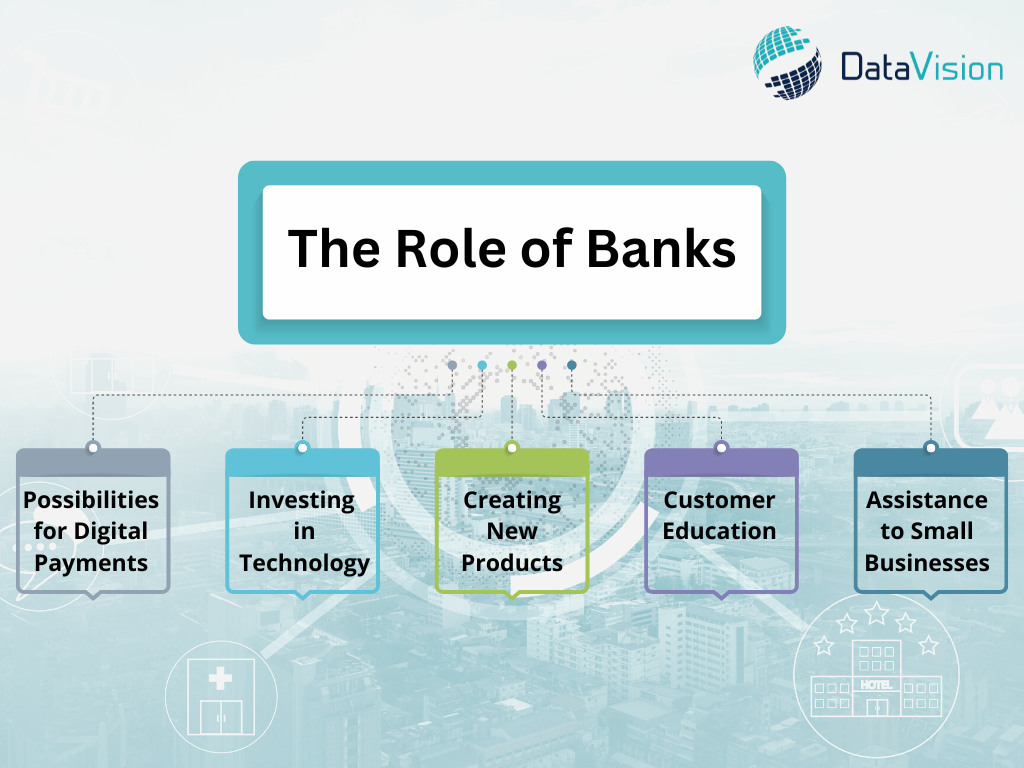

The development of technology has resulted in numerous changes to how people conduct business. Digital payments are steadily displacing cash as the preferred payment method, and this tendency has been growing for a while. The financial sector relies on banks, which is critical to transitioning to a cashless society. With a focus on the banking industry’s viewpoint, we will analyze the role of banks in the shift to a cashless society in this article.

As technology develops, more people are adopting digital payments to conduct business. Banks play a significant role in aiding the shift to a cashless society and are essential stakeholders.

Possibilities for Digital Payments

Banks can offer their consumers Internet payment systems and mobile banking apps as digital payment choices. Customers will find it simple to switch to digital payments, increasing productivity and lowering the possibility of fraud. Customers can also use digital payment solutions to make purchases without using cash, which is often safer.

Investing in Technology

Banks must invest in technology to enhance their digital payment systems to remain competitive. To ensure the efficiency and security of digital payments means spending money on infrastructure like servers and software. Banks can raise customer satisfaction and attract new clients by investing in technology.

Creating New Products

To meet the shifting demands of its consumers, banks might create new products. For instance, banks can provide tools that facilitate consumer mobile payment processing. Examples include mobile payment apps, contactless payment methods, and other electronic payment options. Banks may boost client loyalty and remain ahead of the market by creating innovative products.

Customer Education

Banks can explain to customers the advantages of digital payments and how to use digital payment options. It may entail offering clients educational materials, workshops, and other tools to aid in their understanding of the advantages of electronic payments. Banks may promote digital payment usage and raise customer satisfaction by educating their customers.

Assistance to Small Businesses

By offering digital payment solutions to small enterprises, banks may assist them. Banks can aid small companies in enhancing their cash flow and lowering the likelihood of fraud by doing this. Thanks to digital payment methods, small businesses may find it simpler to take payments from clients, which can increase client loyalty and satisfaction.

The Need for a Cashless Society

A society is called “cashless” if its financial transactions are carried out digitally rather than physically. This transition has various advantages, such as:

Reduced Fraud Risk: The danger of fraud and theft is lower with digital transactions than with cash transactions. Digital payments are a safer alternative because they do away with the need for currency, eliminating the possibility of theft.

Efficiency Gains: Digital transactions are quicker and more effective than cash ones. Counting cash is unnecessary with digital transactions, which can be completed immediately. Due to time savings and productivity gains, digital payments are becoming more popular.

Enhanced Financial Inclusion: A world without currency can increase financial inclusion by enabling more people to engage with the financial system. Mobile devices, more accessible than bank accounts, can be used to conduct digital transactions. Financial inclusion may be improved by making it more straightforward for those without bank accounts to engage in the financial system.

Fraud Prevention Measures

The shift to a cashless society can dramatically lower the risk of fraud since cash transactions are more susceptible to criminal activity. Banks and other financial institutions have used several fraud protection mechanisms, such as multi-factor authentication, biometric identification, and real-time transaction monitoring, to ensure the security of digital transactions. Customers may feel more confident performing transactions since they won’t worry about being taken advantage of or losing their money.

Financial Integration

The shift to a cashless society might encourage financial inclusion by giving more individuals, especially the unbanked or underbanked, access to banking services. Digital payments have the potential to become more convenient, inexpensive, and accessible than traditional banking services, as they can be beneficial for those who live in remote demographic locations or are unable to visit bank facilities. To reach more clients and increase accessibility for everyone, banks have been growing their digital services.

Greater Effectiveness and Cost Savings

Cash transactions can be processed more slowly than digital transactions, saving both banks and customers money. Manual processing, which can be time-consuming and expensive, is no longer necessary with digital payments. Because digital banking services don’t require as much physical presence, banks can also save on the expense of maintaining physical infrastructure like bank offices and ATMs. Customers may get cost savings in the form of lower fees and levies, making banking more accessible to all.

Customer Insights and Data Analytics

Digital transactions produce significant amounts of data, which can be analyzed to learn more about client behavior and preferences. With this information, banks may enhance their offerings and tailor them to the demands of specific clients. Data analytics can also assist banks in identifying possible dangers and fraud, allowing them to take preventative action to stop illegal activity.

Banking in the Future

Moving away from a cash-based society is essential to the current financial system change. Banks must adapt to this development to remain competitive in the market. Digital payments are the way of the future for banking; thus, to stay competitive, banks must make technology investments and provide customers with digital payment options.

The shift to a cashless society can be beneficial for banks and customers. Banks can increase productivity, cut expenses, and provide consumers with specialized services. Greater customer ease, security, and financial inclusion are all possible benefits. For a successful transition to a cashless society, it is crucial for banks to maintain their investments in digital infrastructure and fraud protection techniques.

Conclusion

Banks play a vital role in this transition as the world moves towards a cashless society. By investing in technology, creating new products, educating customers, and assisting small businesses, banks can help make this shift smoother and more accessible for all.

Finally, shifting to a cashless society offers a reduced risk of fraud, increased efficiency, and enhanced financial inclusion. Banks must remain proactive and innovative to stay competitive and support this ongoing transformation.

Datavision’s FinPay financial switch is a payment solution designed on open platforms and offers efficient debit card processing services. It provides reliable acquisition of devices, authentications, card management, settlements, switching to multiple networks and authorizations to card-based transactions from multiple channels. High availability and centralized monitoring and control enhance operations and customer experience. FinPay, with its open platform architecture, helps lower the total ownership cost without affecting performance, reliability and scalability. For more details watch the video below:

FAQs

How Can Datavision help?

We assist various financial institutions and global banks on their digital transformation journey. Our one-of-a-kind approach, which combines people, process, and technology, expedites the delivery of superior results to our clients and drives excellence. Several reputed companies leverage our proprietary suite of business excellence tools and services to unlock new growth levers and unparalleled ROI.

We support a range of financial institutions and global banks on their digital transformation journey. Our unique strategy, which blends people, process, and technology, expedites the delivery of outstanding solutions to our clients and promotes excellence. Several reputable firms utilize our exclusive portfolio of business excellence tools and services to unlock new growth levers and achieve a ROI that is unmatched.

Datavision stands proudly as a prominent banking software solutions provider, recognized for our unwavering commitment to excellence in the industry. We have earned our esteemed reputation by consistently delivering cutting-edge core banking software, catering to the needs of both retail and corporate banking software sectors. At Datavision, our mission is clear: to provide our clients with the best banking software products, ensuring that they stay ahead in an ever-evolving financial landscape. We take pride in serving our prestigious clients and look forward to continuing our journey of innovation and excellence.

Our portfolio of banking software product and services include:

Core Banking Solutions: | FinNext Core | Banking: | FinTrade | EasyLoan | MicroFin |

Digital Banking Solutions: | IBanc | MobiBanc | MBranch | FinTab | FinSight |

Risk & Compliance: |FinTrust |

Want to know how our team of experts at Datavision provides customizable, scalable, and cost-effective banking software products and solutions to our esteemed clients? Visit us for more information.

Ensuring Compliance in Financial Software Development

March 31, 2025

Ensuring Compliance in Financial Software Development

March 31, 2025

The Role of Microservices in Modernizing Core Banking Systems

March 19, 2025

The Role of Microservices in Modernizing Core Banking Systems

March 19, 2025

How Blockchain is Impacting the Future of Banking

March 3, 2025

How Blockchain is Impacting the Future of Banking

March 3, 2025

Data Privacy in Financial Services: Best Practices and Strategies

February 14, 2025

Data Privacy in Financial Services: Best Practices and Strategies

February 14, 2025

Improving Trade Finance Operations through Technology

January 30, 2025

Improving Trade Finance Operations through Technology

January 30, 2025

The Future of Mobile Banking: Trends and Predictions

January 16, 2025

The Future of Mobile Banking: Trends and Predictions

January 16, 2025

A Guide to Effective API Management in Financial Services

December 31, 2024

A Guide to Effective API Management in Financial Services

December 31, 2024

Top Challenges in Developing Secure Fintech Applications

December 16, 2024

Top Challenges in Developing Secure Fintech Applications

December 16, 2024

Best Practices for Implementing EFT Switch Solutions

November 30, 2024

Best Practices for Implementing EFT Switch Solutions

November 30, 2024

Exploring the Benefits of DevOps in Financial Software Development

November 14, 2024

Exploring the Benefits of DevOps in Financial Software Development

November 14, 2024