Safeguarding Financial Institutions: Fortifying Cybersecurity and Data Privacy with Cutting-Edge Banking Software Solutions

In the fast-paced world of financial technology, the influence of Artificial Intelligence (AI) in shaping and driving the future of banking is undeniable. With its ability to analyze, learn from, and act on data, AI is transforming banking from a transaction-driven to an experience-driven sector.

Introduction

Data Privacy and Cybersecurity have become critical concerns for financial institutions in the digital age. As cyber threats evolve, banks and other financial organizations must fortify their defenses with cutting-edge banking software solutions. In this blog, we will learn about the importance of cybersecurity and data privacy in financial institutions and the role of advanced software solutions in ensuring their protection.

Understanding Cyber Threats to Financial Institutions Financial institutions face many cyber threats, including data breaches, ransomware attacks, and phishing attempts. Organizations must recognize and comprehend the risks associated with cybersecurity threats, as they can lead to severe financial losses, harm to reputation, and legal implications. By doing so, adequate measures are taken to secure against these threats.

The Significance of Data Privacy in Banking

Regulatory frameworks, such as GDPR and CCPA, place stringent requirements on financial institutions to protect customer data and privacy. Adhering to these regulations prevents legal consequences and establishes trust with customers. Maintaining data privacy is essential to nurturing a strong client relationship and promoting lasting loyalty.

Exploring Cutting-Edge Banking Software Solutions

Innovative banking software solutions leverage technologies like Our system and use AI and machine learning to identify and stop cyber threats in real-time. We also utilize advanced encryption methods to keep confidential data safe and inaccessible to unauthorized individuals. These technologies play a pivotal role in enhancing the overall security posture of financial institutions.

Strengthening Cybersecurity with Banking Software Solutions

Implementing multi-factor authentication (MFA) adds more protection against unauthorized access. Securing endpoints and networks through firewalls, intrusion detection systems, and regular security audits minimizes vulnerabilities.

Benefits of Fortifying Cybersecurity and Data Privacy with Cutting-Edge Banking Software Solutions

Embracing cutting-edge banking software solutions is not just about staying ahead technologically; it is about protecting stakeholders, optimizing operations, and securing the future of financial institutions.

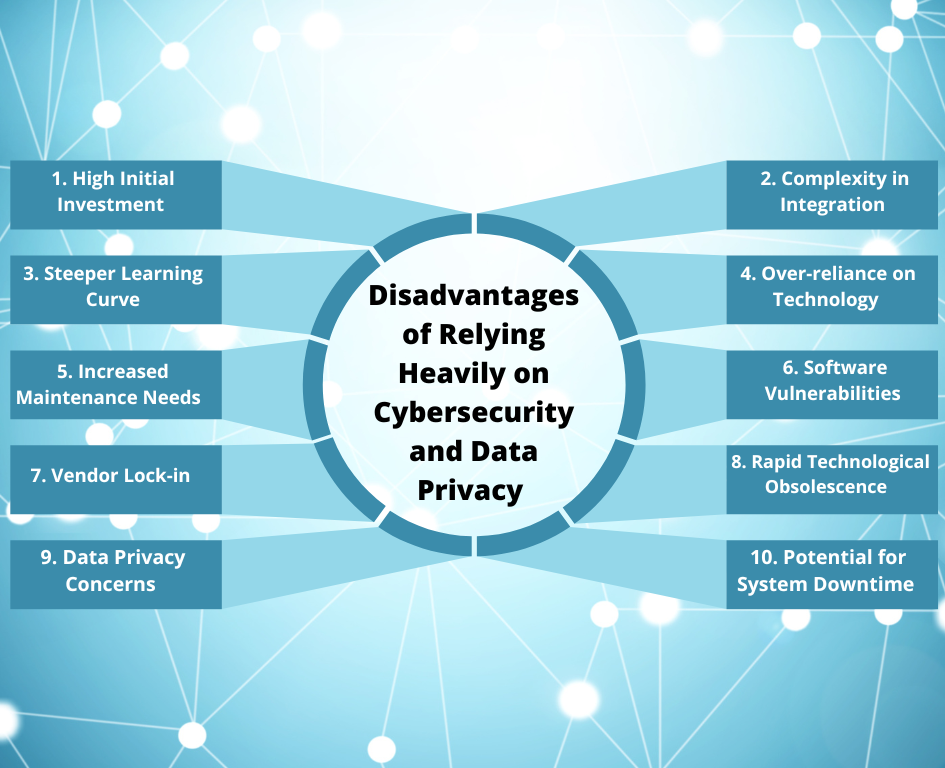

Disadvantages of Relying Heavily on Banking Software Solutions for Cybersecurity and Data Privacy

While innovative banking software solutions offer numerous advantages in fortifying cybersecurity and data privacy, it is essential for financial institutions to weigh these against potential drawbacks. A balanced, well-informed approach is crucial for maximizing benefits and minimizing risks.

Enhancing Data Privacy with Banking Software Solutions

Role-Based Access Controls (RBAC) ensure that employees can only access information relevant to their roles, reducing the risk of internal data breaches. Data encryption and tokenization techniques render data unreadable, even if it falls into the wrong hands.

Ensuring Regulatory Compliance with Banking Software Solutions

Financial institutions rely on Know Your Customer (KYC) and Anti-Money Laundering (AML) solutions to meet regulatory requirements. In addition, using robust banking software solutions can ensure that companies comply with data protection regulations like GDPR and CCPA.

Fostering a Culture of Cybersecurity Awareness

It is vital to educate employees on cybersecurity risks and best practices to prevent security breaches caused by human errors. Creating a security-conscious culture ensures that every staff member takes responsibility for maintaining a secure environment.

Building Customer Trust through Robust Security Measures

Transparent communication regarding security practices and measures helps build customer trust. Showing dedication to safeguarding data reinforces the idea that customer information is handled with the highest level of care.

Conclusion

Safeguarding Financial Institutions with Advanced Banking Software Solutions

The quest for airtight cybersecurity and impeccable data privacy in financial institutions is not just a luxury; it is a necessity. As cyber threats continue to evolve, so should our defense mechanisms. By integrating innovative banking software solutions and fostering a culture of awareness, financial institutions can safeguard their reputation and, more importantly, their customers’ trust. In the digital age, it is not just about keeping money safe but ensuring that every byte of data is treated with the respect and security it deserves.

FAQs (Frequently Asked Questions)

Q. How do innovative banking software solutions protect against cyber threats?

Advanced banking software solutions utilize Artificial Intelligence to instantly identify and prevent cyber threats. Advanced encryption techniques ensure that sensitive data remains secure and inaccessible to unauthorized parties.

Q. What is the significance of data privacy in banking?

Ensuring data privacy is of utmost importance for financial institutions. It helps establish customer trust and ensures compliance with regulatory frameworks such as CCPA and GDPR. Protecting customer data strengthens the relationship between the institution and its clients.

Q. How do banking software solutions strengthen cybersecurity?

Banking software solutions strengthen cybersecurity through multi-factor authentication (MFA) and securing endpoints and networks with firewalls and intrusion detection systems. These measures minimize vulnerabilities to unauthorized access and attacks.

Q. How can financial institutions ensure regulatory compliance with software solutions?

Financial institutions can ensure regulatory compliance with banking software solutions by implementing Anti-Money Laundering (AML) and Know Your Customer (KYC) solutions. This helps us to adhere to regulatory requirements and data protection regulations.

Q. Why is fostering a culture of cybersecurity awareness influential?

Fostering a culture of cybersecurity awareness is crucial as it educates employees about cybersecurity risks and best practices, reducing the likelihood of human error-based security breaches and ensuring a secure environment.

How Can Datavision help?

We assist various financial institutions and global banks on their digital transformation journey. Our one-of-a-kind approach, which combines people, process, and technology, expedites the delivery of superior results to our clients and drives excellence. Several reputed companies leverage our proprietary suite of business excellence tools and services to unlock new growth levers and unparalleled ROI.

Datavision stands proudly as a prominent banking software solutions provider, recognized for our unwavering commitment to excellence in the industry. We have earned our esteemed reputation by consistently delivering cutting-edge core banking software, catering to the needs of both retail and corporate banking software sectors. At Datavision, our mission is clear: to provide our clients with the best banking software products, ensuring that they stay ahead in an ever-evolving financial landscape. We take pride in serving our prestigious clients and look forward to continuing our journey of innovation and excellence.

Our portfolio of banking software product and services include:

Core Banking Solutions: | FinNext Core | Banking: | FinTrade | EasyLoan | MicroFin |

Digital Banking Solutions: | IBanc | MobiBanc | MBranch | FinTab | FinSight |

Risk & Compliance: |FinTrust |

Want to know how our team of experts at Datavision provides customizable, scalable, and cost-effective banking software products and solutions to our esteemed clients? Visit us for more information.