RegTech (Regulatory Technology): Compliance Solutions for Banks in a Changing Regulatory Landscape

Significant changes to compliance procedures, risk management, and regulatory disclosure were implemented due to the RegTech, which has effectively revolutionized the banking sector. RegTech, which stands for regulatory technology, is a rapidly growing sector that employs state-of-the-art technologies to enhance banking sector regulatory processes. The banking industry is significantly impacted by the role of RegTech, which has brought about substantial changes to compliance procedures, risk administration, and regulatory disclosure. RegTech, an emerging industry, utilizes cutting-edge technologies to optimize regulatory guidelines in the banking sector.

As we delve deeper into RegTech’s intricate dimensions, let’s examine certain facets that highlight its profound importance within the banking domain.

Notable Aspects of RegTech’s Function in the Banking Industry

- The detail is in the Data: The utilization of RegTech in the age of big data is crucial for data-driven compliance, as it streamlines and automates compliance processes. RegTech solutions possess the capacity to rapidly analyze vast datasets, which allows them to facilitate real-time monitoring of transactions and regulatory changes. A data-driven methodology guarantees adherence to current regulations and empowers banking institutions to adjust proactively to changing regulatory environments.

- Risk Management Powered by AI: Artificial Intelligence (AI) is currently leading the way in RegTech advancements, fundamentally transforming risk management methodologies in the banking industry. Organizations can make well-informed decisions using sophisticated machine learning algorithms to analyze past data, identify patterns, and predict potential hazards

- Cybersecurity Continuity: The banking sector is compelled to implement robust cybersecurity measures due to the increasing prevalence of cybercrimes. RegTech solutions, which integrate state-of-the-art cybersecurity technologies, are vital in fortifying organizations against cyber threats. These solutions establish a formidable defence mechanism by combining blockchain, biometric authentication, and encryption.

The Function of RegTech within the Banking Sector

RegTech’s function within the banking sector involves using technology to optimize risk management, facilitate regulatory compliance procedures, and guarantee adherence to ever-changing regulatory frameworks. RegTech represents a paradigm shift in artificial intelligence-powered predictive analytics and automated reporting processes, as well as how banking institutions confront the intricate landscape of regulatory responsibilities. The fundamental function of RegTech in the banking sector is to address the complexities of regulatory compliance, risk management, and cybersecurity through the application of technology.

The overarching objectives are improving operational efficiency, decreasing compliance expenses, and mitigating the risks associated with noncompliance. Although RegTech comprises a wide array of technologies and solutions, its operations are guided by the following fundamental principles:

- Automation: Machine learning and robotic process automation (RPA) facilitate streamlining manual tasks, saving time and reducing errors. By automating rule-based and repetitive duties, RPA further streamlines compliance processes. It eliminates the need for human labour, enabling them to concentrate on more intricate and strategic facets of regulatory compliance.

- Data Analytics: Robust algorithms analyze extensive datasets to detect concealed patterns and forecast possible compliance concerns.

- Cloud Computing: Enterprise-grade RegTech solutions are accessible via scalable cloud platforms, eliminating the need for substantial initial investments.

- Regulatory intelligence: It provides banking institutions with up-to-date information and valuable insights regarding the dynamic regulatory environment.

- Blockchain Technology: RegTech solutions progressively incorporate blockchain, characterized by its decentralized structure and resistance to tampering, to augment the security and transparency of banking transactions and regulatory reporting.

- Machine learning: Using machine learning algorithms and associated predictive analytics tools is crucial when analyzing extensive datasets. These tools enable the proactive detection of patterns and trends, improving the precision of risk assessments and compliance monitoring.

Let’s observe how reg tech approaches actual banking challenges:

- Anti-Money Laundering (AML): To prevent money laundering, RegTech solutions analyze transaction data, detect suspicious activity, and generate alerts.

- Know Your Customer (KYC): To ensure adherence to KYC regulations, automated customer onboarding procedures validate identities and evaluate risk profiles.

- Capital Adequacy Ratio (CAR): RegTech models optimize resource allocation and ensure regulatory compliance by dynamically calculating capital requirements.

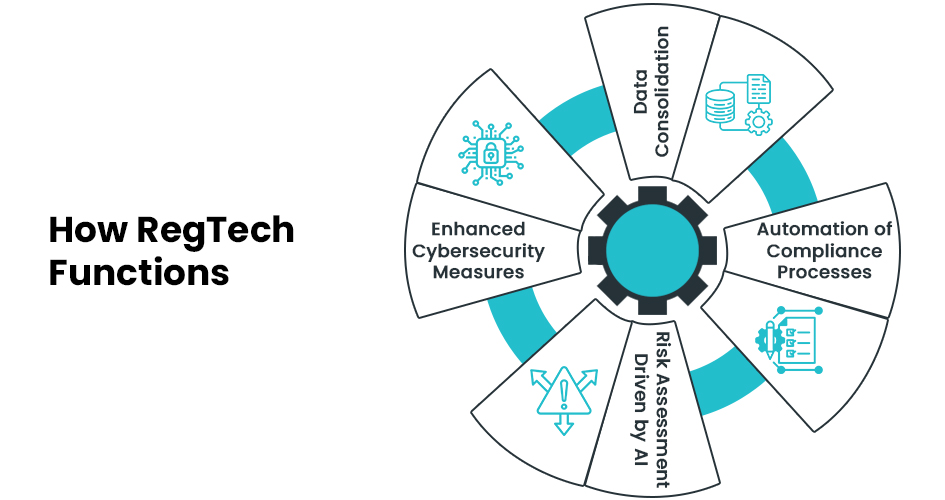

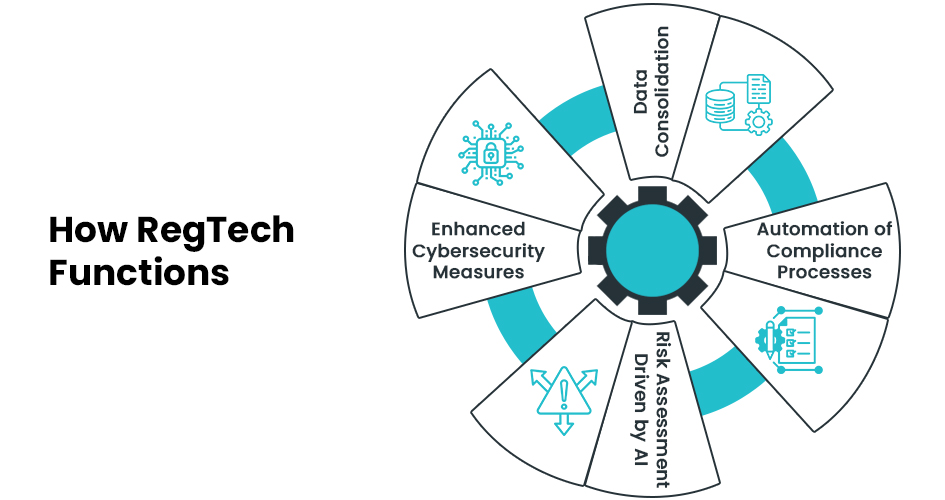

How RegTech Functions:

- Data consolidation: The initial step of RegTech solutions is consolidating extensive banking data from various sources. This information is sorted by sophisticated analytics tools, which detect patterns, anomalies, and possible compliance issues. Through real-time monitoring, banking institutions can proactively address emergent risks and remain abreast of regulatory changes.

- Automation of Compliance Processes: Automation of compliance processes is a fundamental capability of RegTech. It encompasses the generation of regulatory reports, compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) obligations, and surveillance of transactions to identify potentially fraudulent activities. Automation expedites compliance and reduces human error.

- Risk Assessment Driven by AI: Artificial intelligence algorithms evaluate and quantify many risks banking institutions encounter. Whether it be operational risk, market risk, or credit risk, AI-driven RegTech solutions offer a comprehensive view of the risk environment. Institutions can proactively implement preventive measures and optimize their risk management strategies by adopting a proactive approach.

- Enhanced Cybersecurity Measures: RegTech solutions necessitate incorporating state-of-the-art cybersecurity measures. Blockchain and biometric authentication technologies augment the security and integrity of data, respectively, by introducing an additional level of protection.

Banking institutions’ persistent vigilance and threat intelligence systems guarantee their resilience in the face of ever-changing cybersecurity risks. Innovations in technology, alterations in regulations, and the pursuit of operational excellence within the banking sector all contribute to the dynamic nature of RegTech’s role. In light of the progressively intricate and critical regulatory environment that banking institutions traverse, RegTech emerges as a paradigm of ingenuity, providing institutions with solutions that guarantee adherence and enable them to flourish amidst the perpetually shifting banking terrain.

Unique features of RegTech:

- Real-Time Reporting and Monitoring: RegTech solutions allow banking institutions to monitor in real-time, enabling them to remain informed about regulatory modifications and promptly resolve compliance concerns. Incorporating sophisticated reporting tools enables the smooth generation and submission of regulatory reports, thereby mitigating the labour-intensive nature of manual procedures.

- Flexibility and Scalability: Many RegTech solutions are engineered to accommodate the expanding requirements of banking institutions. Due to their adaptable and modular design, these systems can be tailored to meet particular regulatory demands, guaranteeing versatility in changing compliance environments without requiring substantial reconstructions.

- AI driven analytics: Using artificial intelligence-driven predictive analytics in risk management enables banking institutions to detect and alleviate potential risks proactively. By examining market trends and historical data, RegTech solutions enhance risk management strategies, thereby facilitating a more resilient and well-informed decision-making process.

- Strengthened Security Protocols: RegTech highly emphasizes cybersecurity, incorporating cutting-edge technologies such as encryption and blockchain. By implementing these safeguards, banking institutions protect sensitive banking data and enhance their overall resilience to cyber threats.

Benefits of RegTech:

- Cost-Efficiency: By automating compliance processes, banking institutions can allocate resources more strategically by eliminating the operational expenses associated with manual labour. The increases in efficiency ultimately result in substantial cost savings.

- Automated regulatory processes: Implementing automated regulatory processes mitigates the probability of human error, thereby promoting precision in compliance reporting. It facilitates greater regulatory compliance and cultivates an elevated confidence level in the banking system.

- Regulatory Change Adaptability: RegTech solutions enable banking institutions to promptly adjust to modifications in regulatory obligations. The adaptability and agility provided by these technologies enable institutions to maintain compliance in changing regulatory environments.

- Risk Management Enhanced Capabilities: Implementing artificial intelligence and predictive analytics empowers banking institutions to detect and mitigate potential risks before their escalation proactively. Adopting this proactive stance enhances the stability and resilience of the economic ecosystem.

Benefits of RegTech:

- Credit Score Monitoring: Propose RegTech as an attentive custodian of your banking affairs, overseeing your credit activities in real-time. It assures an accurate credit score evaluation, which can be advantageous in obtaining loans or mortgages with favourable conditions. It is comparable to being under the supervision of a personal banking advisor who monitors your credit health.

- Fraud Detection: RegTech functions as a digital detective against fraudulent activities by employing sophisticated algorithms to identify atypical patterns in banking transactions. Visualize it as an intelligent security system that promptly detects any suspicious activity and prevents unauthorized access to your funds about your monetary transactions.

- Business Automated Compliance Checks: Organizations that utilize RegTech observe streamlined compliance procedures. It reduces the likelihood of legal issues by ensuring adherence to all applicable regulations, similar to having an automated compliance assistant. This system gives businesses precise navigation through the intricate regulatory environment, analogous to a GPS.

Sectors that Implement RegTech in the Banking Industry:

- Banking and Banking Services: RegTech is used by conventional banks and banking institutions to optimize compliance procedures, bolster risk management, and guarantee the security of banking transactions.

- Insurance: RegTech is utilized by the insurance sector to automate compliance, detect fraud, and assess risk. It guarantees that insurance companies can efficiently manage intricate regulatory frameworks and deliver dependable services to their policyholders.

- Fintech Startups: Fintech startups integrate RegTech solutions to construct a robust regulatory framework from the beginning. By adhering to regulations, they establish themselves as reliable participants in the banking ecosystem.

In summary, RegTech applies to banking sector stakeholders.

Conclusion

RegTech’s impact on the banking industry is a dynamic and ever-changing phenomenon that imbues regulatory processes with unparalleled precision, effectiveness, and protection. In light of the continuous proliferation of regulatory frameworks, banking institutions implement RegTech solutions as a strategic imperative. By integrating sophisticated technologies, real-time monitoring, and predictive analytics, RegTech is pivotal in influencing banking compliance and risk management trajectories in the coming years. A banking landscape that is technologically empowered, transparent, and resilient is made possible through the collaborative efforts of regulators, banking institutions, and innovative RegTech providers. The banking industry can anticipate a RegTech landscape that is compliant, adaptable, and robust in the presence of swift transformations and unpredictability.

How Can Datavision help?

We assist various financial institutions and global banks on their digital transformation journey. Our one-of-a-kind approach, which combines people, process, and technology, expedites the delivery of superior results to our clients and drives excellence. Several reputed companies leverage our proprietary suite of business excellence tools and services to unlock new growth levers and unparalleled ROI.

Datavision stands proudly as a prominent banking software solutions provider, recognized for our unwavering commitment to excellence in the industry. We have earned our esteemed reputation by consistently delivering cutting-edge core banking software, catering to the needs of both retail and corporate banking software sectors. At Datavision, our mission is clear: to provide our clients with the best banking software products, ensuring that they stay ahead in an ever-evolving financial landscape. We take pride in serving our prestigious clients and look forward to continuing our journey of innovation and excellence.

Our portfolio of banking software product and services include:

Core Banking Solutions: | FinNext Core | Banking: | FinTrade | EasyLoan | MicroFin |

Digital Banking Solutions: | IBanc | MobiBanc | MBranch | FinTab | FinSight |

Payments: | FinPay |

Risk & Compliance: |FinTrust |

Want to know how our team of experts at Datavision provides customizable, scalable, and cost-effective banking software products and solutions to our esteemed clients? Visit us for more information.