DataVision was founded in 1992 with the purpose of providing clients with customisable, scalable and affordable banking software products and solutions.

Uchil Heights, Jagdishnagar, Raj Bhavan Road, Aundh, Pune - 411007, Maharashtra, India

+91-20-25690661/2/3

info@datavsn.com

This blog post examines the top retail banking trends and projections for 2022, including the impact of financial technologies. AI, cloud, robotics, APIs, and cyber security. The latest technology enables companies to improve consumer experience and introduce new products and services.

The rise in digital banking, focus on innovation, new technologies, and changing industry dynamics are concerns that require management, but they also present opportunities in the banking sector. Every financial institution should build new business models, deploy new technology, and become customer-focused.

Most banks haven’t moved their essential core systems to the cloud. Why? Because data control, governance, security, and various risks induce much anxiety in them. According to a recent survey in 2020, less than 10% of essential banking workloads have been moved to the cloud. Banks must improve their speed and scalability. Financial organizations should adopt cloud computing technologies. The bank’s transition to core cloud computing would improve customer insights, innovation, efficiency, agility, and security and business continuity threats.

Cloud computing solutions boost staff productivity and deliver 360-degree insights. Over 80% of organizations report operational gains after using the technology. Most financial institutions’ obsolete technology disappoints clients. It is not easy to update, expensive to maintain, and doesn’t work well. Moving to the cloud is the best flexible choice for banks. Smaller banks can employ this technology to compete with larger ones.

Banking-as-a-service provides end-to-end financial services online. BaaS integrates digital banking services into non-banking products. An ECommerce website can offer loan payment services, mobile payment cards, and debit cards without obtaining a banking license. Banks can increase their revenue by adopting BaaS. A bank’s goal is to reduce costs and increase revenue. BaaS also helps traditional banks build new income models. These models let banks commercialize their capabilities, data, and infrastructure.

Revenue-sharing agreements, one-time setup costs, and subscription fees are ways banks can boost their bottom line with BaaS. Getting a banking license is complex, and there are several regulatory requirements. Non-banking service companies will gladly partner with banks to avoid this hassle of regulatory compliance.

Embedded Banking or Embedded finance integrates financial services with a non-financial service. For example, Uber is coupled with payroll automation software, allowing customers to make embedded payments. Embedded banking connects financial services with consumers. It strategically streamlines access to financial services. Embedded banking is the latest trend that has gained much traction these days.

Companies of all sizes are launching embedded financial services for individuals and enterprises. Most banks see it as an opportunity rather than a threat to existing banking rules. Consumers want to stay in an app throughout the buying cycle; therefore, embedded financial services are popular and have a promising future. Businesses implementing embedded solutions should either buy, partner, or license embedded finance technology as they will benefit from it.

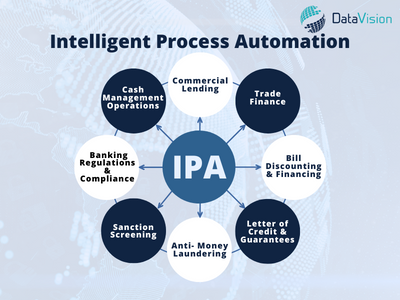

IPA includes cognitive automation, computer vision, machine learning, robotic process automation, and the application of artificial intelligence.

IPA can automate the following:

IPA can automate the following:

Besides the above, IPA also automates Import & export payments, payment operations, Payment investigations and Inward and outward payments.

Most banks struggle to implement intelligent automation despite knowing its benefits. It is recommended to start small with IPA and focus on the value each process will achieve once integrated across various financial systems. Without a computerized back office, the value of customer service deliverability can decline. Automating the strategies mentioned above will transform how customers view their banks. Most financial organizations will use IPA in 2022 to improve customer experiences.

Since banks are cost-cutting measures to regain normalcy, they must engage in digital transformation to compete and meet online needs. Digital transformation would enable a remote workforce and preserve corporate continuity by 2022.

Today’s banking institutions prioritize innovation. Financial institutions are cutting expenses by simplifying redundant IT systems, consolidating core platforms, decreasing contractor spending, offloading non-essential businesses, digitalizing additional services, and reducing office space.

Here are some cost-cutting measures banks took:

In Banking 4.0, financial organizations should offer customers contextual and lifestyle banking experiences. Banks should leverage data to build practical customer experiences. Banks have tons of data but can only be used as part of the value chain. Focusing on the customer experience requires employing several technologies and being adaptable.

Even though Agile has technical constraints, its early delivery and continuous development mindset can be the best. To offer experiential banking, banks must simplify and update their technological stacks using microservices, lightweight and reactive systems, analytics, AI, and machine learning.

Anyone born after 1996 is categorized as Gen Z. Millions of people become adults. All of them will need financial services at a certain point in time. They have different outlooks because they have a distinct perspectives on money and other topics. They’re also the world’s largest generation at 32% of its population. Freebies won’t attract Gen Z’ers as they’re well-informed and sensitive. They expect a fair banking user experience. Banks must carefully provide them with direction and financial liberty. Instead of a faceless relationship, banks can take advantage of social media platforms to offer financial knowledge and awareness. A rapport-building strategy is essential to connect with Gen Z. Application of personalized interfaces such as profile photos, incentive systems emojis, rewards and gamification seem more accessible.

Conclusion: Covid-19 caught banks unaware of the situation’s severity. Even with more viral varieties, ambiguity remains. In retrospect, banks are better prepared for 2022.

Improving client experience is a top priority for banks. They’llThey’llcus on operational excellence to provide exceptional client service. While banks have found new models and revenue streams, they should embrace the latest technologies and processes to stay relevant. The last several months have reminded banks of the necessity of utilizing technology; now is the time to be innovative.

Technological advancement is leading FinTech development. Industry insiders have called 2022 “the year of value chain disruption” backed by AI and smart contracts (blockchain). Although technology has been disrupting the financial services value chain for a while, the attention will be more on such activities in 2022. As countries struggle to develop national regulatory norms, digital wallets are booming.

Technology is transforming the models, roles, and competitive environment of financial institutions and the markets and people they serve. Regulatory frameworks have been implemented globally post-crisis, and financial institutions have reshaped their business models. Accelerating digital innovation is the most creative and destructive factor in today’s financial services ecosystem. It is safe to say that these new technology developments will drive banking and fintech innovation in 2022 and beyond.

If you are a financial institution looking for a technology partner for a complete digital transformation, you have come to the right place. Datavision prides itself on working with leading banking and financial services organizations, taking care of their technological needs, and improving their operational competency. Contact us to know more.

Datavision stands proudly as a prominent banking software solutions provider, recognized for our unwavering commitment to excellence in the industry. We have earned our esteemed reputation by consistently delivering cutting-edge core banking software, catering to the needs of both retail and corporate banking software sectors. At Datavision, our mission is clear: to provide our clients with the best banking software products, ensuring that they stay ahead in an ever-evolving financial landscape. We take pride in serving our prestigious clients and look forward to continuing our journey of innovation and excellence.

Get in touch with us for customizable, scalable, and affordable banking software products and solutions. Our portfolio of banking software product and services include:

Core Banking Solutions

FinNext Core | FinNext Islamic Banking | FinTrade | EasyLoan | MicroFin

Digital Banking Solutions

IBanc | MobiBanc | MBranch | FinTab | FinSight

Risk & Compliance

FinTrust | InvestRite

Want to know how our team of experts at Datavision offer our reputed clients customisable, scalable and affordable banking software products and solutions? Visit us to know more.

Ensuring Compliance in Financial Software Development

March 31, 2025

Ensuring Compliance in Financial Software Development

March 31, 2025

The Role of Microservices in Modernizing Core Banking Systems

March 19, 2025

The Role of Microservices in Modernizing Core Banking Systems

March 19, 2025

How Blockchain is Impacting the Future of Banking

March 3, 2025

How Blockchain is Impacting the Future of Banking

March 3, 2025

Data Privacy in Financial Services: Best Practices and Strategies

February 14, 2025

Data Privacy in Financial Services: Best Practices and Strategies

February 14, 2025

Improving Trade Finance Operations through Technology

January 30, 2025

Improving Trade Finance Operations through Technology

January 30, 2025

The Future of Mobile Banking: Trends and Predictions

January 16, 2025

The Future of Mobile Banking: Trends and Predictions

January 16, 2025

A Guide to Effective API Management in Financial Services

December 31, 2024

A Guide to Effective API Management in Financial Services

December 31, 2024

Top Challenges in Developing Secure Fintech Applications

December 16, 2024

Top Challenges in Developing Secure Fintech Applications

December 16, 2024

Best Practices for Implementing EFT Switch Solutions

November 30, 2024

Best Practices for Implementing EFT Switch Solutions

November 30, 2024

Exploring the Benefits of DevOps in Financial Software Development

November 14, 2024

Exploring the Benefits of DevOps in Financial Software Development

November 14, 2024