Artificial Intelligence in Banking: Enhancing Customer Experience and Operational Efficiency

Over the past decade, the exponential growth of AI application development in financial solutions has sparked fierce competition among modern banks. This competition is about providing the most individualised customer experiences and a monumental transformation of the banking industry. Artificial intelligence and related technologies like natural deep learning, language processing, and machine learning are the primary forces behind this change.

According to the AI Development Company, majority of financial institutions, including banks, are projected to spend billions on integrating AI into their existing systems. These statistics are a clear testament to the financial sector’s recognition of artificial intelligence as a tool to enhance operational efficiency and productivity. This article will delve into the leading AI applications in banking and how this technology is reshaping the financial sector’s customer experience. Let’s dive in.

What is the purpose of AI in banking?

Artificial intelligence is transforming the banking industry, empowering institutions to optimise operations, manage risks, and deliver tailored banking services. The extensive use of AI in banking is not just about increasing consumer satisfaction and user experience, but also about enhancing efficiency and reducing costs.

AI automates repetitive and mundane tasks such as data entry and fraud detection, enhancing operational efficacy and decreasing labour expenses. In addition, chatbots fueled by AI provide round-the-clock customer assistance. Simultaneously, machine learning algorithms can effectively analyse customer data, customise services based on individual preferences, and identify suspicious transactions. This results in enhanced security within the financial sectors.

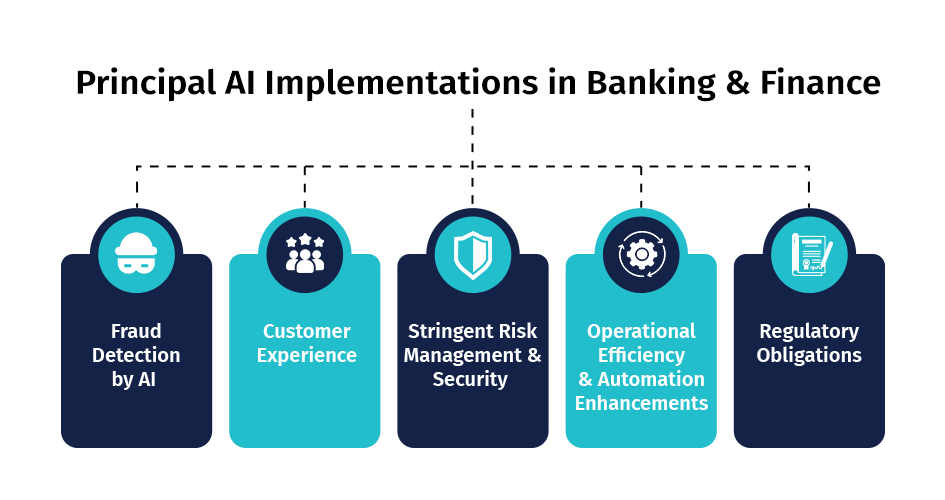

Principal AI Implementations in Banking and Finance

From a technical standpoint, AI comprises several technologies, such as computer vision, NLP, and machine learning, which automate banking sector workflows and generate well-informed decisions. A selection of noteworthy AI-driven The following are examples of mobile applications and AI in banking and finance:

1. Fraud Detection by AI

Security is paramount in accounting and financial-related activities. AI technology can detect fraud and ensure all financial transactions are secure in real-time. It enables financial institutions to effectively detect and prevent fraudulent transactions and identify potential system vulnerabilities. It ultimately results in enhanced customer satisfaction and robust security.

In addition, biometric authentication systems based on artificial intelligence, including fingerprint scanning and facial recognition, offer additional protection within the banking industry. These sophisticated technologies reduce the likelihood of fraudulent transactions and unauthorised access while enhancing identity verification.

2. Customer Experience

One of the primary domains within the financial industry where artificial intelligence exerts a significant influence is customer experience. AI-driven chatbots and virtual assistants are created to provide quick customer service solutions around the clock. Intelligent systems can efficiently handle routine enquiries and offer tailored financial solutions.

It increases customer satisfaction and enables personnel to prioritise more intricate duties. Various artificial intelligence applications are also employed to assess user behaviour and consumer preferences. The provision of tailored financial guidance, individualised recommendations, and focused promotional activities contribute to enhanced and more captivating customer experiences within the banking sector.

3. Stringent Risk Management and Security

As online transactions become more prevalent, ensuring the utmost security of transactional data and financial information is a top priority. AI algorithms play a vital role in efficiently detecting fraudulent activities and protecting all data, instilling confidence in the security of the banking system.

Furthermore, machine learning extensively examines financial data in real-time, encompassing non-traditional data sources such as social media activities and online behaviour, to produce more accurate credit scores. AI risk management consistently adjusts to transformative market conditions, furnishing banks and financial sectors with invaluable insights that facilitate informed decision-making.

4. Operational Efficiency and Automation Enhancements

Implementing AI in the finance industry transcends solutions centred on the customer. It significantly contributes to the enhancement of automation and operational efficiency. For example, intelligent AI and robotic process automation simplify monotonous tasks like data entry, document processing, and compliance monitoring. Additionally, this permits personnel and banking experts to focus on activities that provide more excellent value and are more strategic. This results in innovations and well-informed decision-making.

5. Regulatory Obligations

Ensuring adherence to regulations is a critical component of the global financial sector. Cutting-edge AI and machine learning technologies enhance the decision-making processes of banking and financial sectors by interpreting the most recent compliance requirements via NLP and deep learning.

By implementing AI technology, financial institutions and banks can increase the precision and velocity of their monitoring procedures, thereby reducing the likelihood of reputational harm and penalties. These AI-driven systems facilitate adherence to compliance standards and foster an accountable and transparent financial ecosystem.

Advantages of AI Implementation in Banking

The integration of AI into finance brings a multitude of benefits to the banking industry. It not only transforms conventional banking solutions but also enhances the entire banking ecosystem.

The most essential advantages of artificial intelligence in financial services are the following:

1. Customer Experience Enhancement:

2. Optimised Operational Efficiency:

3. Automated Fraud Detection:

4. Strategic Decision-making:

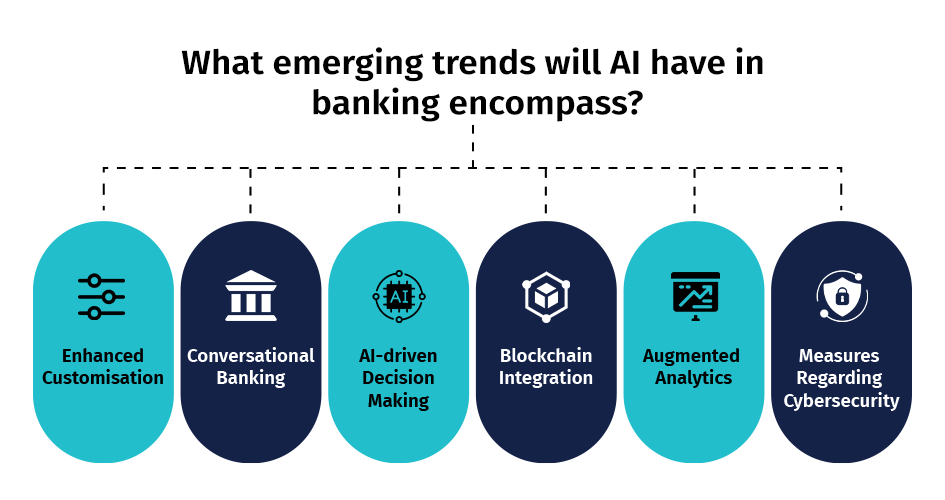

What emerging trends will AI have in banking encompass?

The potential of artificial intelligence banking applications in the future is immense and will significantly revolutionise the entire industry. As AI technology advances, a range of modern financial trends are anticipated to arise:

1. Enhanced Customisation: Artificial intelligence will enable financial institutions and industries to offer tailored suggestions and resolutions by analysing client inclinations, actions, and economic objectives. Hyper-personalisation also improves product offerings, investment advice, and customised financial planning.

2. Conversational Banking: Implementing conversational AI and NLP technology will facilitate the development of more sophisticated and advanced virtual assistants and chatbots. It will aid in the efficient management of complex consumer enquiries and the provision of comprehensive financial advice. Additionally, voice-enabled interactions will become more widespread, enhancing user experience and smoother customer interactions.

3. AI-driven Decision-Making: In the banking industry, AI algorithms are highly influential in formulating strategic and informed decisions. AI provides invaluable insights for data-driven decision-making regarding credit approval procedures, risk management, investment decisions, and credit approval procedures. Implementing AI in decision-making processes will enhance operational efficiency and optimise workflows.

4. Blockchain Integration: Integrating blockchain technology with artificial intelligence holds promise for detecting obstacles to the efficacy and security of various banking operations. Integrating both technologies will enhance the integrity of financial transactions and information. AI-powered intelligent contracts will also automate intricate agreements and smoothly expedite contract execution.

5. Augmented Analytics: Augmented analytics enhance data analytics primarily by applying artificial intelligence and machine learning technology. It can be crucial in deriving significant insights from extensive datasets. Augmented analytics has become a prevalent tool utilised by numerous banking and financial institutions to identify trends, correlations, and patterns. Therefore, risk management and fraud detection are improved.

6. Measures Regarding Cybersecurity: AI will significantly contribute to implementing cybersecurity measures to mitigate financial threats. Intelligent AI algorithms can perpetually analyse and mitigate risks to safeguard financial data, which contributes substantially to preventing financial threats in real-time. Additionally, AI-powered authentication will enhance the security level within the banking industry.

Conclusion

Customised AI integration in banking has brought revolutionary technical innovations that have completely changed the financial services industry. Aside from enhancing security measures and customer experiences, AI is advancing banking solutions in numerous ways. However, in light of the increasing adoption of artificial intelligence in the financial sector, it is critical to strike a balance between the progress of AI and ethical concerns. Strict data privacy regulations guarantee the effectiveness and sustainability of the AI transformation in banking applications. A highly dynamic and consumer-centric financial environment is what the future holds for AI in banking.

How Can Datavision help?

We assist various financial institutions and global banks on their digital transformation journey. Our one-of-a-kind approach, which combines people, process, and technology, expedites the delivery of superior results to our clients and drives excellence. Several reputed companies leverage our proprietary suite of business excellence tools and services to unlock new growth levers and unparalleled ROI.

Datavision stands proudly as a prominent banking software solutions provider, recognized for our unwavering commitment to excellence in the industry. We have earned our esteemed reputation by consistently delivering cutting-edge core banking software, catering to the needs of both retail and corporate banking software sectors. At Datavision, our mission is clear: to provide our clients with the best banking software products, ensuring that they stay ahead in an ever-evolving financial landscape. We take pride in serving our prestigious clients and look forward to continuing our journey of innovation and excellence.

Our portfolio of banking software product and services include:

Core Banking Solutions: | FinNext Core | Banking: | FinTrade | EasyLoan | MicroFin |

Digital Banking Solutions: | IBanc | MobiBanc | MBranch | FinTab | FinSight |

Risk & Compliance: |FinTrust |

Want to know how our team of experts at Datavision provides customizable, scalable, and cost-effective banking software products and solutions to our esteemed clients? Visit us for more information.