Boosting Efficiency and Empowering Banks: Workforce Automation Revolutionizes the Banking Industry

In the fast-paced world of finance, where precision and speed are paramount, banks have always been at the forefront of technological innovation. From the advent of ATMs to the rise of online banking, financial institutions have consistently sought. Here are some suggestions on how to enhance customer service and simplify operations. Now, a new wave of transformation is sweeping the banking industry – workforce automation. This technological revolution promises to boost efficiency and empower banks like never before.

The Banking Industry in the Digital Age

The banking industry has undergone a profound transformation in recent decades. Gone are the days of long queues at brick-and-mortar branches, replaced by the convenience of mobile banking apps and online transactions. While these technological advancements have improved customer experience, they have intensified competition among banks.

Banks increasingly turn to workforce automation to stay ahead in this fiercely competitive landscape. This strategy involves using technologies such as artificial intelligence (AI), robotic process automation (RPA), and data analytics to optimize their operations.

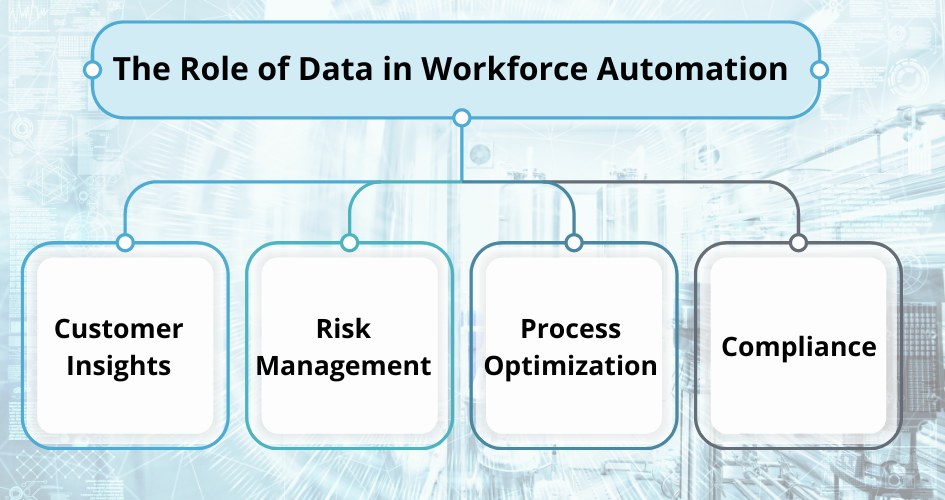

The Role of Data in Workforce Automation

Data is the lifeblood of the modern banking industry. Banks deal with vast data daily, from customer profiles and transaction histories to risk assessments and compliance records. Leveraging this data is crucial for operational efficiency and providing better customer service.

Workforce automation in banking begins with harnessing the power of data. Advanced analytics and AI algorithms enable banks to gain valuable insights from their data. For instance:

Customer Behavior Analysis: Banks can use automation tools to analyze vast customer data, including transaction histories, online interactions, and account activity. Banks can uncover valuable insights into customer behaviour by utilizing cutting-edge analytics and machine learning algorithms. This analysis might reveal patterns such as preferred banking channels, spending habits, and life events (e.g., buying a home or having a child) impacting financial needs.

Personalized Services: With these insights, banks can tailor their services to each customer’s needs and preferences. For example, they can offer personalized product recommendations, such as credit cards with benefits aligned with a customer’s spending habits. This level of personalization enhances the customer experience by making banking more relevant and convenient.

Driving Sales and Loyalty: Customers are more likely to engage and make additional purchases when banks provide relevant offers and recommendations. It can lead to increased cross-selling and upselling opportunities, driving revenue growth. Moreover, customers who feel understood and valued will likely remain loyal to the bank, reducing customer churn.

Predictive Analytics: In real-time, predictive analytics employs historical data and machine learning algorithms to detect potential risks and anomalies. Banks can apply this technology to detect suspicious patterns in transaction data, account activity, or customer behaviour. For example, predictive analytics can detect unusual spending patterns that might indicate fraud or identity theft.

Proactive Risk Mitigation: Identifying risks in real time allows banks to take proactive measures to mitigate potential losses. For instance, if a transaction appears suspicious, the bank can automatically alert the customer for verification or temporarily block the transaction until confirmed as legitimate. It safeguards the bank’s assets and enhances customer trust and security.

Efficient Account Openings: Automation can simplify and accelerate the account opening process. New customers can provide information online, and automation efficiently verifies and processes the data. It reduces paperwork, minimizes errors, and enhances the onboarding experience.

Customer Onboarding: When customers open a new account or apply for a service, automation can guide them through the necessary steps. Automated email or SMS reminders can prompt customers to complete required actions, ensuring a smooth onboarding process. It not only reduces the risk of abandonment but also enhances customer satisfaction.

Continuous Monitoring: Automation tools enable banks to continuously monitor transactions, customer data, and processes for compliance with regulatory requirements. This ongoing monitoring helps banks stay aligned with complex and evolving regulations, reducing non-compliance risk.

Real-time Reporting: Automated compliance systems can generate real-time bank operations reports. These reports can be invaluable for demonstrating compliance to regulators and auditors. Furthermore, they facilitate quick responses to any compliance issues that may arise.

Audit Trails: Automation provides detailed audit trails, tracking changes and activities within the bank’s systems. This transparency enhances accountability and ensures compliance deviations can be traced back and addressed promptly.

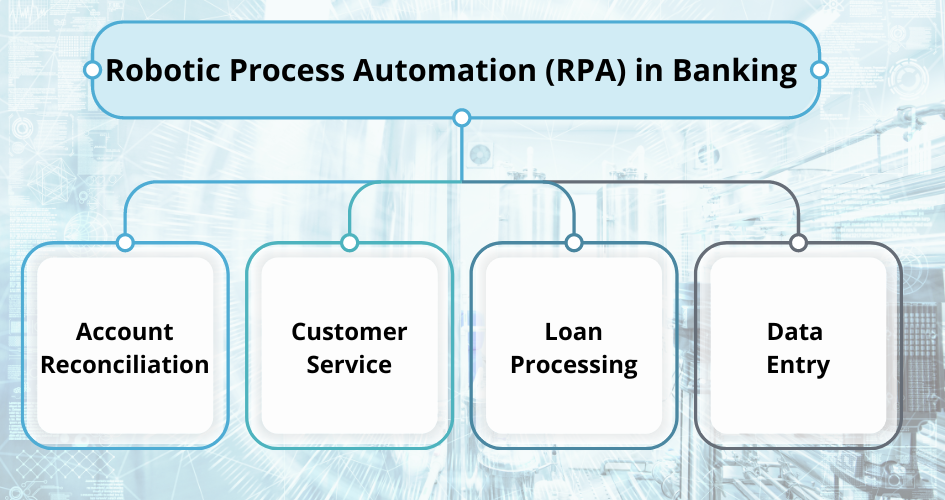

Robotic Process Automation (RPA) in Banking

One of the key enablers of workforce automation in banking is RPA. RPA involves using software robots or bots to automate repetitive, rule-based tasks. In the banking industry, RPA can be applied to a wide range of processes, including:

Automation Process: Account reconciliation involves matching financial transactions in a bank’s records with corresponding entries in a customer’s statement or external records, such as those from vendors or clearinghouses. Automation streamlines this process by employing algorithms to automatically identify and match transactions based on specific criteria like date, amount, and reference number.

Reducing Errors: Manual account reconciliation can be prone to human errors, leading to discrepancies and financial inaccuracies. Automation significantly reduces the risk of errors by eliminating the need for human intervention in the matching process. It enhances data accuracy and the bank’s financial integrity.

Speeding up Reconciliation: Automation can process large volumes of transactions quickly. This speed reduces the time required for reconciliation and allows banks to reconcile accounts more frequently. Frequent reconciliation provides a real-time view of financial positions, improving financial decision-making.

24/7 Availability: One of the main benefits of using chatbots and virtual assistants is their ability to offer support 24/7. Customers can get assistance at any time, enhancing convenience and accessibility. This continuous support can also help reduce customer frustration and waiting times.

Human-Agent Offloading: Human customer service agents can focus on more complex and high-value interactions by automating routine inquiries and tasks. It improves the overall efficiency of customer service operations and allows agents to provide more personalized assistance when needed.

Automated Data Collection and Validation: Automation in loan processing simplifies and accelerates collecting and validating customer information required for loan applications. Customers can provide documentation online, and automation systems can verify and validate the information swiftly.

Faster Approval Process: With automation, banks can expedite the loan approval process significantly. Automated credit scoring models can evaluate creditworthiness using more data, resulting in faster decisions. It reduces the time customers must wait for loan approval.

Reduced Manual Workload: Automation eliminates the need for manual data entry and reduces the paperwork associated with loan processing. It accelerates the process, reduces the risk of errors, and guarantees regulatory compliance.

Automated Data Extraction: Automation tools can extract data from various sources, including physical documents, emails, and digital forms. Optical character recognition (OCR) technology is often used to convert text from scanned documents into machine-readable data.

Input Efficiency: By automating data entry, banks eliminate the need for manual input, reducing the risk of data entry errors. Additionally, automation tools can validate and clean the data as it is entered, ensuring data accuracy.

Time and Resource Savings: Automating data entry saves time and resources that would otherwise be spent on manual data input and verification. This efficiency can lead to faster decision-making and more streamlined processes throughout the bank.

RPA accelerates these processes, reduces operational costs, and minimizes the risk of errors. It allows banks to allocate their human resources more strategically, focusing on tasks that require creativity, empathy, and critical thinking, ultimately improving customer satisfaction.

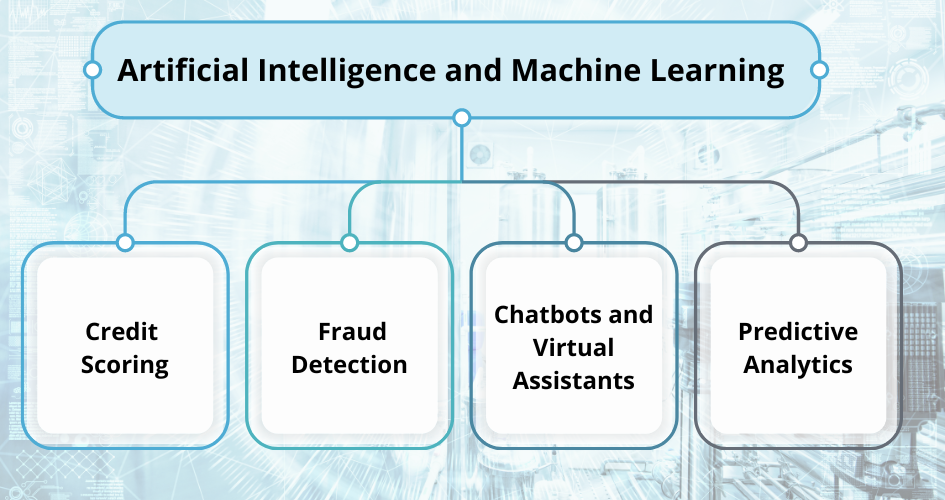

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are taking automation in the banking industry to a whole new level. These technologies enable banks to make data-driven decisions, predict customer needs, and enhance security. Here are some key applications of AI and ML in banking:

Credit scoring: AI algorithms can assess a customer’s creditworthiness more accurately by analyzing a wider range of data points, potentially expanding access to credit for more individuals.

Fraud detection: Machine learning models can continuously analyze transactions and detect unusual patterns indicative of fraud, helping banks prevent financial losses.

Chatbots and virtual assistants: AI-powered chatbots can engage with customers in natural language, providing instant support and assistance 24/7.

Predictive analytics: AI can forecast market trends, helping banks make informed investment decisions and offer timely financial advice to customers.

Benefits of Workforce Automation in Banking:

Challenges and Considerations of Workforce Automation in Banking:

Understanding these benefits and challenges is essential for banks to make informed decisions about adopting workforce automation. Proper planning and strategic implementation can maximize the advantages while mitigating the associated challenges and risks.

Conclusion

Workforce automation is revolutionizing the banking industry, ushering in a new era of efficiency and empowerment. Through the strategic use of AI, RPA, and data analytics, banks can optimize operations, provide superior customer experiences, and stay competitive in a rapidly evolving landscape.

As the banking industry continues to evolve, embracing automation is not just an option; it’s necessary for banks looking to thrive in the digital age. By harnessing the power of data and technology, banks can boost their efficiency and empower their workforce to focus on what matters most – delivering value to their customers. The future of banking is automated, and it’s a future filled with opportunities for growth and innovation.

Frequently Asked Questions (FAQs):

Q 1. Is workforce automation in banking safe and secure?

Ans. Banks prioritize data security and use advanced measures to protect customer information. Automation systems are designed with security in mind, and compliance with industry regulations is a top priority.

Q 2. Will automation in banking lead to job losses?

Ans. While some routine jobs may be automated, banks also invest in reskilling their workforce for more complex roles. Automation aims to enhance efficiency rather than eliminate jobs.

Q 3. How does automation benefit customers?

Ans. Automation leads to faster response times, personalized services, and improved customer support, resulting in a better banking experience.

Q 4. What are the challenges of implementing automation in banks?

Ans. Challenges include the initial costs of implementation, data security risks, regulatory compliance, and the need to build and maintain customer trust in automated systems.

Q 5. Can smaller banks benefit from workforce automation?

Ans. Yes, automation is scalable and adaptable to banks of all sizes. Smaller banks can benefit by automating specific processes to increase efficiency and competitiveness.

How Can Datavision help?

We assist various financial institutions and global banks on their digital transformation journey. Our one-of-a-kind approach, which combines people, process, and technology, expedites the delivery of superior results to our clients and drives excellence. Several reputed companies leverage our proprietary suite of business excellence tools and services to unlock new growth levers and unparalleled ROI.

Datavision stands proudly as a prominent banking software solutions provider, recognized for our unwavering commitment to excellence in the industry. We have earned our esteemed reputation by consistently delivering cutting-edge core banking software, catering to the needs of both retail and corporate banking software sectors. At Datavision, our mission is clear: to provide our clients with the best banking software products, ensuring that they stay ahead in an ever-evolving financial landscape. We take pride in serving our prestigious clients and look forward to continuing our journey of innovation and excellence.

Our portfolio of banking software product and services include:

Core Banking Solutions: | FinNext Core | Banking: | FinTrade | EasyLoan | MicroFin |

Digital Banking Solutions: | IBanc | MobiBanc | MBranch | FinTab | FinSight |

Risk & Compliance: |FinTrust |

Want to know how our team of experts at Datavision provides customizable, scalable, and cost-effective banking software products and solutions to our esteemed clients? Visit us for more information.