Cryptocurrency and Blockchain: Opportunities and Challenges for Banks

In recent years, cryptocurrency has gained popularity as an alternative to traditional banking methods. Cryptocurrency is a decentralised digital currency that operates autonomously from central banking institutions and is secured through cryptographic measures. While conventional banking practices have existed for centuries, cryptocurrency is a new concept that has gained popularity in the last decade. The potential effects of cryptocurrencies on the banking sector are as follows.

Strict Barriers To Entry

In contrast to the stipulations of conventional banking services, cryptocurrencies offer a more convenient means of entrance, requiring solely a smartphone or internet connection. It suggests that individuals unable to utilise traditional banking services because of banking or geographical constraints can still engage in cryptocurrency transactions. An example would be a person in a remote area lacking banking infrastructure who can utilise cryptocurrencies to convert BTC to USD, circumventing the necessity for extensive travel.

Decentralised Finance As Opposed To Centralised

For centuries, conventional banking systems have dominated the banking sector. These centralised systems use a network of intermediaries to manage risk, facilitate transactions, and ensure economic stability. Nevertheless, cryptocurrencies give rise to an entirely distinct methodology known as decentralised finance (DeFi).

Distributed ledgers, or blockchains, are the underlying technology of cryptocurrencies; they log transactions across an extensive network of computers. It eliminates the necessity for central authorities, thereby establishing a banking system characterised by greater openness and transparency.

Speed And Effectiveness

Conventional bank transfers may entail latency and complications. Settlement of international transactions, for example, can require multiple days due to the intricate web of intermediaries involved. In contrast, the peer-to-peer dynamics of blockchain technology enable cryptocurrency transactions to be executed with remarkable efficiency and at a substantially reduced expense.

This efficacy can potentially streamline international transactions for businesses and individuals, thereby transforming cross-border payments. Imagine a forthcoming era wherein transferring funds to overseas family members is as expeditious and seamless as sending a text message.

Clearance And Settlement Systems Mechanisms

As mentioned earlier, the primary cause of the three-day delay in a bank transfer is the configuration of Banking infrastructure. Not only does this procedure cause inconvenience for the client, but it also presents the institutions with a formidable logistical obstacle. A straightforward bank transfer (the movement of funds between accounts) must now traverse an intricate web of intermediaries.

It consists of correspondent institutions and custodial services until the item reaches its final destination. Amidst a vast global banking system comprised of a heterogeneous network of merchants, funds, and asset managers, the two bank balances must be reconciled.

Financial Accessibility And Inclusion

Traditional institutions have a higher barrier to entry than cryptocurrencies. Frequently, substantial documentation, a minimum balance, and physical proximity to a branch are required to open a bank account. It may result in the exclusion of a significant proportion of the worldwide populace, especially individuals residing in developing countries that have restricted availability of conventional banking services.

In contrast, creating cryptocurrency wallets requires only a smartphone and an internet connection. It facilitates the participation of unbanked and underbanked communities in the banking system, which may lead to greater economic empowerment and banking inclusion.

Contributions to fundraising

The process of obtaining venture capital funding can be difficult. In exchange for banking investment, entrepreneurs must compile presentations, attend numerous meetings with partners, and engage in extensive negotiations regarding equity and the company’s value. On the contrary, certain companies are procuring funds via initial coin offerings (ICOs), supported by publicly traded blockchains such as Ethereum and Bitcoin. Projects exchange tokens or currencies through an ICO for funding, typically bitcoin or ether. Theoretically, the worth of these tokens is contingent upon the prosperity of the blockchain enterprise. Token investments provide a direct method for investors to wager on their utility and value.

Security

A mechanism for tracking ownership is required when purchasing or selling assets such as stocks, debt, and commodities through securities. The present banking markets accomplish this through the following mechanisms:

These diverse entities function under an antiquated system of paper ownership that could be more efficient and resistant to errors and fraud. To illustrate, if you purchase a quantity of any stock, you should initiate an order via a stock exchange, which connects you with a seller. Historically, this transaction required the exchange of cash for a tangible certificate attesting to one’s ownership of a certain number of shares.

However, the situation becomes more complicated when these transactions are attempted to be completed electronically. We would rather avoid engaging in routine asset management activities, including certificate swaps, bookkeeping, and dividend processing. Consequently, for the purpose of secure storage, we entrust our shares to custodian institutions.

However, because not all sellers and purchasers use the same custodian banks, these custodians must rely on a reliable third party to protect the physical certificates.

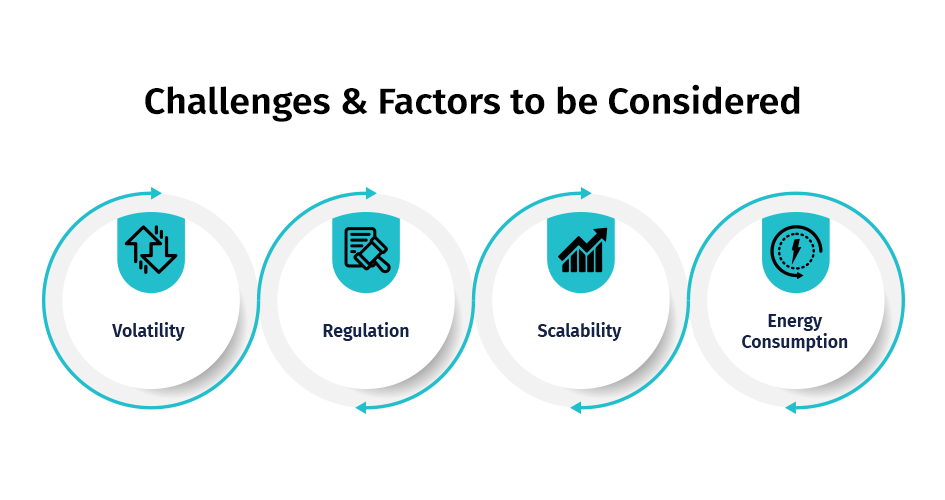

Challenges And Factors To Be Considered

Although cryptocurrency offers an intriguing prospect for the future of finance, it is not without its considerable obstacles:

Conclusion

Despite the undeniable disruptive nature of cryptocurrency’s emergence, conventional banking need not cease to exist. The two sectors could potentially collaborate in the coming years. Banks may integrate blockchain technology into their operations to deliver expedited and more efficient services. Banks and cryptocurrency trading companies may partner to provide custodial services and ensure legal compliance.

A hybrid banking model that integrates the most advantageous characteristics of traditional banks and cryptocurrencies could ultimately be the key to the future of banking. As regulations become more transparent and technology progresses, we might expect to witness a banking system that is more interconnected, inclusive, efficient, and secure.

The banking domain has undergone a significant transformation in the past decade due to the rise and expansion of digital currencies, which has accompanied increased market values. The increase in the utilisation of digital currencies can be ascribed to a more extraordinary fascination with decentralised systems, a growing recognition of these currencies as a feasible means of wealth storage and transaction, and broadening acceptability among private and corporate entities.

How Can Datavision help?

We assist various financial institutions and global banks on their digital transformation journey. Our one-of-a-kind approach, which combines people, process, and technology, expedites the delivery of superior results to our clients and drives excellence. Several reputed companies leverage our proprietary suite of business excellence tools and services to unlock new growth levers and unparalleled ROI.

Datavision stands proudly as a prominent banking software solutions provider, recognized for our unwavering commitment to excellence in the industry. We have earned our esteemed reputation by consistently delivering cutting-edge core banking software, catering to the needs of both retail and corporate banking software sectors. At Datavision, our mission is clear: to provide our clients with the best banking software products, ensuring that they stay ahead in an ever-evolving financial landscape. We take pride in serving our prestigious clients and look forward to continuing our journey of innovation and excellence.

Our portfolio of banking software product and services include:

Core Banking Solutions: | FinNext Core | Banking: | FinTrade | EasyLoan | MicroFin |

Digital Banking Solutions: | IBanc | MobiBanc | MBranch | FinTab | FinSight |

Risk & Compliance: |FinTrust |

Want to know how our team of experts at Datavision provides customizable, scalable, and cost-effective banking software products and solutions to our esteemed clients? Visit us for more information.