Cybersecurity in Finance: Protecting Against Data Breaches and Cyber Attacks

Financial services, a diverse sector that includes banks, credit unions, credit card companies, insurance providers, consumer finance providers, investment funds, stock brokerages, and certain government-backed businesses, play a vital role in the world economy. They provide credit, facilitate trade, and enable businesses to invest and grow their wealth, making them an integral part of global financial stability.

Technological advancements have made digital banking, online investing platforms, electronic payment systems, and other web-based financial services possible. The digital revolution has improved the accessibility and convenience of financial services.

However, the move to digital platforms has also brought up new difficulties, especially regarding cybersecurity.

Financial organizations are popular targets for cybercriminals because they handle large sums of money and sensitive data. These are the principal causes behind the growing concern over cybersecurity in the financial industry.

Cybersecurity’s Significance in Financial Services

For financial services companies, cybersecurity is crucial for the following reasons:

Protection of Sensitive Data

Financial firms manage many personal and financial data, such as their clients’ names, addresses, credit card numbers, social security numbers, and transaction histories. Customers like this data, but hackers who exploit it for fraudulent operations also find it essential. Various cybersecurity tools are used by financial services businesses to safeguard sensitive financial data. Cybersecurity ensures that data is only accessible to authorized users and systems through strong authentication procedures, encryption, and secure networks. To reduce harm, it also offers means to identify and address any illegal access or data breaches.

Preventing Monetary Losses

Cyberattacks have the potential to cause large financial damage. Cybercriminals can not only take money straight out of bank accounts or make fraudulent purchases using credit card numbers they have obtained, but they can also face legal fees, regulatory fines, and reputational harm due to data breaches. Cybercrime in the financial services sector is becoming increasingly expensive. If a cyberattack is successful, significant financial damages may occur, regulatory penalties, and a tarnished reputation, highlighting the critical role of financial services cybersecurity in averting such losses.

Preserving Customer Trust

Customer trust is the cornerstone of the financial services industry. Any betrayal of this confidence, such as a successful cyberattack or data leak, can seriously harm a financial institution’s standing among its clients. Cybersecurity in financial services contributes to the preservation of client trust and reassures customers that their information and funds are secure, boosting their confidence in the financial institution’s offerings.

Compliance to Regulations

Financial institutions function within a strict regulatory framework that establishes rules to guarantee the safety and soundness of economic systems and safeguard customers. These include laws like the Payment Card Industry Data Security Standard (PCI DSS), the Dodd-Frank Act, the Bank Secrecy Act (BSA), and the Sarbanes-Oxley Act (SOX), among others. These laws require a range of cybersecurity precautions. Businesses must, for instance, secure cardholder data, put robust access control mechanisms in place, uphold an information security strategy, and routinely test and monitor networks to comply with the Payment Card Industry Data Security Standard (PCI-DSS).

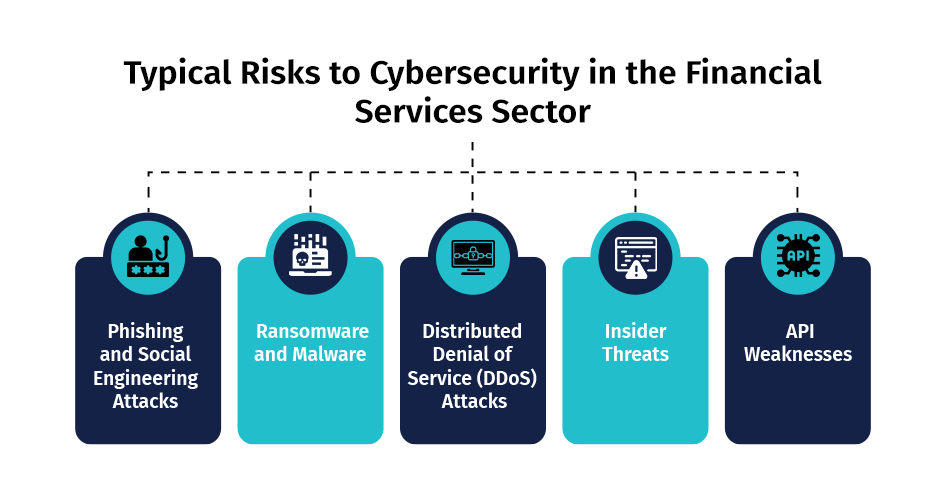

Typical Risks to Cybersecurity in the Financial Services Sector

Phishing and Social Engineering Attacks

Social engineering and phishing attacks are common cybersecurity concerns in the financial services industry. Cybercriminals utilize these assaults to deceive victims into disclosing personal or financial information, sometimes by assuming the identity of reputable businesses. For example, they could email the individual posing as their bank and ask the customer to share their account information or verify a transaction. Several cybersecurity precautions can help avoid these assaults. These include employing email filtering systems to halt phishing emails, educating clients about the dangers of social engineering and phishing assaults, and utilizing multi-factor authentication to prevent unwanted access, even if login credentials are obtained.

Ransomware and Malware

Malware, including ransomware, is another common cybersecurity concern in financial services. Malware is harmful software that can gather personal information, disrupt regular computer operations, and gain unwanted access to computer systems. Ransomware encrypts files on a computer and requests money for the key. Robust malware protection can prevent these attacks. To decrease the impact of ransomware attacks, it entails installing and updating antivirus software, patching and updating systems to address vulnerabilities, monitoring network traffic for malware, and regularly backing up data.

Distributed Denial of Service (DDoS) Attacks

A Distributed Denial of Service (DDoS) attack is used by cybercriminals to flood a network, service, or infrastructure with traffic, forcing it offline. DDoS attacks against financial institutions can be used as a distraction while attackers attempt to infiltrate their systems, interrupt services, result in losses, or both. Financial services firms have several options for defending against DDoS assaults. Implementing DDoS protection systems that can identify and reduce DDoS traffic and attacks is essential. Keeping redundant systems up to date helps ensure availability even during an attack. Preparing for DDoS incidents in advance is crucial to providing a prompt and efficient reaction.

Insider Threats

Cybersecurity dangers that come from within the company are known as insider threats. Insider threats are those posed by workers, subcontractors, or anyone with access to an organization’s data and systems. Since these individuals often have legitimate access and are familiar with the organization’s systems and procedures, addressing such threats can be challenging. Financial services companies prioritize access control, monitoring, and training to prevent insider threats. It involves ensuring that individuals only have access to the necessary information and platforms for their roles, actively monitoring for unusual or suspicious activity, and providing employees with training to identify and respond to cybersecurity threats.

API Weaknesses

The financial industry uses application programming interfaces (APIs) to connect different systems and services. If APIs are not adequately secured, hackers can use weaknesses to access data and systems without authorization. It is essential to use secure coding techniques, conduct regular security testing, and implement API security gateways to prevent API vulnerabilities. Monitoring API activity and responding swiftly during a breach is also crucial.

Cybersecurity Solutions in Financial Services

Financial institutions use cybersecurity solutions to defend their services and client data from cyberattacks.

The following are some of the most crucial preventative actions:

1. Firewalls for web applications: Positioned between a web application and the Internet, a WAF is a protective barrier. Data packets are tracked, filtered, and blocked throughout their transit to and from a website or online application. By implementing a WAF, financial institutions can stop common web-based threats like SQL injection, brute force attacks, and cross-site scripting (XSS). Policies are the collection of guidelines that govern how a WAF operates. These policies specify which traffic should be permitted through and which should be prohibited. Financial institutions must regularly update these rules to avoid new dangers. Frequent security audits can assist in finding weak points in WAF policies and making the necessary updates. See our in-depth guide to next-generation firewalls for more information.

1. Firewalls for web applications: Positioned between a web application and the Internet, a WAF is a protective barrier. Data packets are tracked, filtered, and blocked throughout their transit to and from a website or online application. By implementing a WAF, financial institutions can stop common web-based threats like SQL injection, brute force attacks, and cross-site scripting (XSS). Policies are the collection of guidelines that govern how a WAF operates. These policies specify which traffic should be permitted through and which should be prohibited. Financial institutions must regularly update these rules to avoid new dangers. Frequent security audits can assist in finding weak points in WAF policies and making the necessary updates. See our in-depth guide to next-generation firewalls for more information.

2. Defense Against DDoS Attacks: Cybercriminals overwhelm a network, service, or server with a deluge of Internet traffic during a denial-of-service assault. Services crashing or slowing down may cause severe business disruption. Financial organizations can reduce the danger of DDoS attacks by implementing DDoS protection solutions. These programs monitor network activity and spot anomalous activity spikes that might be signs of a DDoS attack. The DDoS prevention solution minimizes disturbance by redirecting suspect traffic from the network once it is discovered.

2. Defense Against DDoS Attacks: Cybercriminals overwhelm a network, service, or server with a deluge of Internet traffic during a denial-of-service assault. Services crashing or slowing down may cause severe business disruption. Financial organizations can reduce the danger of DDoS attacks by implementing DDoS protection solutions. These programs monitor network activity and spot anomalous activity spikes that might be signs of a DDoS attack. The DDoS prevention solution minimizes disturbance by redirecting suspect traffic from the network once it is discovered.

3. Fraud Prevention and Anti-Fraud Measures: Online fraud presents a substantial threat to the financial services industry. Fraudsters steal crucial financial information using various methods, including card fraud, identity theft, and phishing. Financial institutions can identify and stop fraudulent conduct with anti-fraud technologies. These technologies use machine learning algorithms and advanced analytics to check suspicious patterns and behaviors pointing to fraudulent activity. By quickly detecting fraud in real-time, financial institutions can avert financial loss.

3. Fraud Prevention and Anti-Fraud Measures: Online fraud presents a substantial threat to the financial services industry. Fraudsters steal crucial financial information using various methods, including card fraud, identity theft, and phishing. Financial institutions can identify and stop fraudulent conduct with anti-fraud technologies. These technologies use machine learning algorithms and advanced analytics to check suspicious patterns and behaviors pointing to fraudulent activity. By quickly detecting fraud in real-time, financial institutions can avert financial loss.

4. Identity and Access Management: (IAM) A framework for business processes called identity and access management (IAM) makes it easier to handle electronic identities. The technological components required to facilitate identity management include user provisioning, single sign-on (SSO), and multi-factor authentication (MFA). IAM makes sure that the appropriate people, for the proper reasons, have access to the appropriate resources at the appropriate times. It is crucial in limiting illegal access to private information and system access. Financial organizations can reduce the risk of data breaches by implementing stringent access controls with IAM.

4. Identity and Access Management: (IAM) A framework for business processes called identity and access management (IAM) makes it easier to handle electronic identities. The technological components required to facilitate identity management include user provisioning, single sign-on (SSO), and multi-factor authentication (MFA). IAM makes sure that the appropriate people, for the proper reasons, have access to the appropriate resources at the appropriate times. It is crucial in limiting illegal access to private information and system access. Financial organizations can reduce the risk of data breaches by implementing stringent access controls with IAM.

5. Solutions for Advanced Threat Protection: To identify and stop sophisticated cyber attacks, ATP systems combine several technologies, including email security, network security, endpoint protection, and analytics on harmful activity. These systems offer automatic reaction capabilities and real-time threat intelligence. Advanced threat prevention (ATP) technologies are crucial for safeguarding financial institutions against sophisticated cyber threats.

5. Solutions for Advanced Threat Protection: To identify and stop sophisticated cyber attacks, ATP systems combine several technologies, including email security, network security, endpoint protection, and analytics on harmful activity. These systems offer automatic reaction capabilities and real-time threat intelligence. Advanced threat prevention (ATP) technologies are crucial for safeguarding financial institutions against sophisticated cyber threats.

6. Vulnerability assessment Penetration testing (VAPT): VAPT entails locating, evaluating, and ranking a system’s vulnerabilities. It is a thorough evaluation to find flaws and gauge a system’s security posture. VAPT aids in meeting regulatory compliance requirements, safeguarding sensitive data, and preventing data breaches in the financial services industry. Proactive cybersecurity means that possible risks are found and eliminated before they can do any harm.

6. Vulnerability assessment Penetration testing (VAPT): VAPT entails locating, evaluating, and ranking a system’s vulnerabilities. It is a thorough evaluation to find flaws and gauge a system’s security posture. VAPT aids in meeting regulatory compliance requirements, safeguarding sensitive data, and preventing data breaches in the financial services industry. Proactive cybersecurity means that possible risks are found and eliminated before they can do any harm.

7. Programs for Security Awareness and Training: If end users need to be made aware of cyber risks and how to prevent them, even the most advanced cybersecurity solutions may be useless. Security training and awareness programs are designed to inform users about the different types of cyber threats, how they operate, and the best ways to defend against them. These training courses are very crucial in the financial services industry. They give consumers of digital financial solutions trust in addition to aiding in protecting sensitive financial data.

7. Programs for Security Awareness and Training: If end users need to be made aware of cyber risks and how to prevent them, even the most advanced cybersecurity solutions may be useless. Security training and awareness programs are designed to inform users about the different types of cyber threats, how they operate, and the best ways to defend against them. These training courses are very crucial in the financial services industry. They give consumers of digital financial solutions trust in addition to aiding in protecting sensitive financial data.

8. Monitoring of Data Activity: Unauthorized access to or modification of data can have disastrous results in the financial services business. The data activity monitoring system keeps track of and logs every real-time action on a database. Data activity monitoring adds another degree of protection in the financial services industry. It assists in defending against internal threats as well as external ones, which are frequently disregarded. It guarantees the confidentiality and integrity of the financial data by closely monitoring all data operations.

8. Monitoring of Data Activity: Unauthorized access to or modification of data can have disastrous results in the financial services business. The data activity monitoring system keeps track of and logs every real-time action on a database. Data activity monitoring adds another degree of protection in the financial services industry. It assists in defending against internal threats as well as external ones, which are frequently disregarded. It guarantees the confidentiality and integrity of the financial data by closely monitoring all data operations.

9. Data risk analytics: Analytics of data risks is a proactive strategy for cybersecurity. The data must be examined to find possible dangers and threats. This study uses advanced algorithms and machine learning approaches to see trends and anomalies that point to a cyber threat. Data risk analytics gives financial services a competitive advantage. Proactive risk management is made possible by its ability to anticipate potential hazards. It also contributes to regulatory compliance by offering an unbiased evaluation of the data dangers.

9. Data risk analytics: Analytics of data risks is a proactive strategy for cybersecurity. The data must be examined to find possible dangers and threats. This study uses advanced algorithms and machine learning approaches to see trends and anomalies that point to a cyber threat. Data risk analytics gives financial services a competitive advantage. Proactive risk management is made possible by its ability to anticipate potential hazards. It also contributes to regulatory compliance by offering an unbiased evaluation of the data dangers.

Conclusion

A secure and resilient cybersecurity infrastructure is essential for the financial industry’s future. As cyber threats continue to expand, it is imperative that financial institutions adopt innovative technology, cultivate a robust cybersecurity culture, and invest strategically to secure their operations and the interests of their clients. By prioritizing cybersecurity, the financial industry can create a secure digital world for all stakeholders.

How Can Datavision help?

We assist various financial institutions and global banks on their digital transformation journey. Our one-of-a-kind approach, which combines people, process, and technology, expedites the delivery of superior results to our clients and drives excellence. Several reputed companies leverage our proprietary suite of business excellence tools and services to unlock new growth levers and unparalleled ROI.

Datavision stands proudly as a prominent banking software solutions provider, recognized for our unwavering commitment to excellence in the industry. We have earned our esteemed reputation by consistently delivering cutting-edge core banking software, catering to the needs of both retail and corporate banking software sectors. At Datavision, our mission is clear: to provide our clients with the best banking software products, ensuring that they stay ahead in an ever-evolving financial landscape. We take pride in serving our prestigious clients and look forward to continuing our journey of innovation and excellence.

Our portfolio of banking software product and services include:

Core Banking Solutions: | FinNext Core | Banking: | FinTrade | EasyLoan | MicroFin |

Digital Banking Solutions: | IBanc | MobiBanc | MBranch | FinTab | FinSight |

Risk & Compliance: |FinTrust |

Want to know how our team of experts at Datavision provides customizable, scalable, and cost-effective banking software products and solutions to our esteemed clients? Visit us for more information.