Financial Technology (FinTech) Partnerships: Collaboration and Innovation in Banking

The world of finance has undergone a remarkable transformation in recent years, driven by the emergence of Financial Technology, or FinTech. This innovative industry combines technology and financial services to create efficient and user-friendly solutions for individuals and businesses. In the ever-evolving landscape of FinTech, partnerships and collaborations have become essential in driving innovation and shaping the future of banking. In this blog, we will study the significance of FinTech partnerships, the various types of collaborations taking place, the benefits and challenges they bring that highlight the power of cooperation in FinTech.

Table of Contents

Introduction

The Evolution of FinTech Partnerships

Types of FinTech Partnerships

Key Drivers for FinTech Partnerships

Challenges and Risks in FinTech Partnerships

Best Practices for Establishing FinTech Partnerships

The Future of FinTech Partnerships

Conclusion

Frequently Asked Questions (FAQs)

How can DataVision Help

Introduction

Technological advancements have revolutionized the financial sector, giving rise to the term “FinTech.” FinTech encompasses many digital applications, platforms, and services that aim to improve traditional financial processes, making them more accessible, efficient, and customer-centric. In an era where convenience and speed are paramount, FinTech has emerged as a disruptive force, challenging traditional banking models and prompting incumbents to adapt or risk becoming obsolete.

Partnerships and collaborations have become integral to the FinTech ecosystem, as they enable companies to leverage each other’s strengths and resources, fostering innovation and expanding market reach. By combining the agility and innovation of FinTech startups with the scale and infrastructure of established financial institutions, these partnerships have the potential to reshape the banking industry and deliver groundbreaking solutions to consumers.

The Evolution of FinTech Partnerships

In the early stages of FinTech disruption, startups aimed to displace traditional banks and financial institutions by offering specialized services and superior user experiences. However, as the industry matured, a shift towards collaboration and partnerships became evident. Startups realized that by partnering with established players, they could access capital, regulatory expertise, and a large customer base, while incumbents recognized the need to embrace technological advancements and harness the creativity and agility of FinTech innovators.

Several factors have fueled this shift towards collaboration:

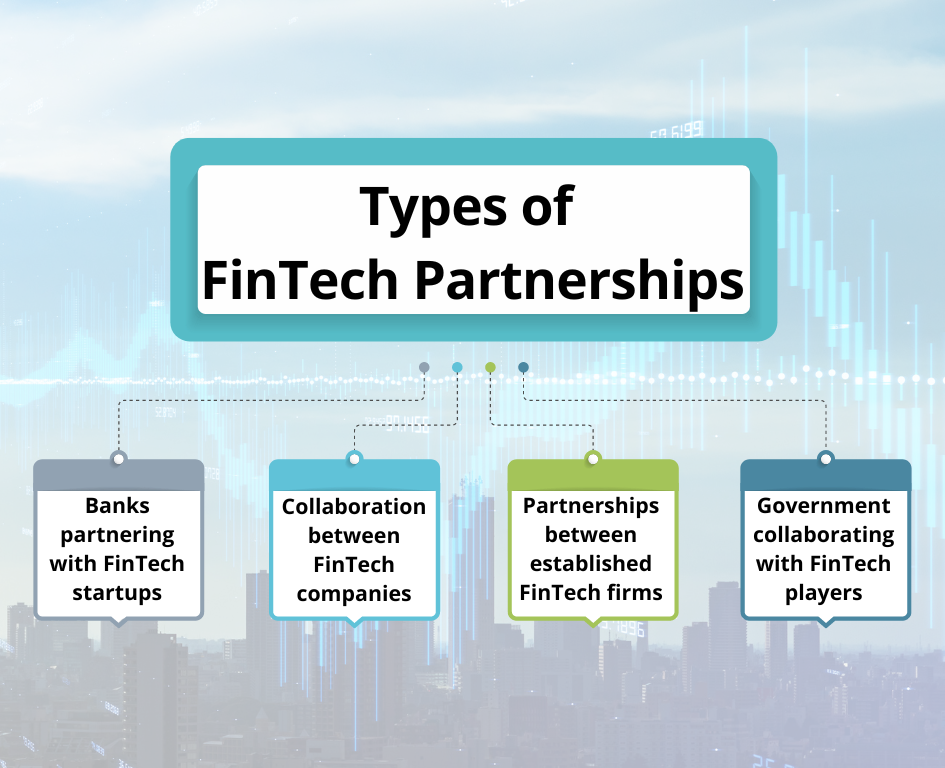

Types of FinTech Partnerships

FinTech partnerships take various forms, each with its unique benefits and objectives. Let’s explore some of the most common types of collaborations that have emerged in the industry:

These different types of partnerships reflect the diverse goals and strategies of the organizations involved. Whether it’s seeking innovation, market expansion, or regulatory compliance, FinTech partnerships offer a collaborative path to success.

Key Drivers for FinTech Partnerships

Several vital drivers motivate companies to enter into FinTech partnerships. Let’s explore these drivers and understand their significance in the context of collaboration and innovation:

FinTech partnerships lay the foundation for collaborative innovation and growth in the financial industry by addressing these key drivers.

Challenges and Risks in FinTech Partnerships

While FinTech partnerships offer numerous benefits, they are not without challenges and risks. Let’s explore some of the common hurdles faced during the collaboration process:

Best Practices for Establishing FinTech Partnerships

To maximize the benefits of FinTech partnerships, organizations should follow some best practices:

By following these best practices, organizations may form solid and successful partnerships that foster innovation and add value for all parties involved.

The Future of FinTech Partnerships

Looking ahead, the future of FinTech partnerships is promising. The industry will continue to witness emerging trends and technologies that shape the landscape of collaboration and innovation in banking.

One such trend is the potential for cross-industry partnerships. As FinTech expands its influence, collaborations between financial institutions and companies from other industries, such as retail, healthcare, and transportation, will likely emerge. These partnerships can lead to innovative solutions catering to customers’ diverse needs across various sectors.

Conclusion

In conclusion, FinTech partnerships are instrumental in driving collaboration and innovation in the banking industry. These collaborations bring together the strengths and resources of traditional financial institutions and FinTech startups, paving the way for transformative solutions that meet customers’ evolving needs.

While challenges and risks exist, proactive communication, compatibility, and a shared vision can mitigate these hurdles and ensure successful partnerships. The future of FinTech partnerships holds great potential, with cross-industry collaborations and customer-centric approaches set to shape the industry further.

By embracing the power of collaboration, financial institutions and FinTech companies can build a more robust, innovative ecosystem that redefines banking and delivers exceptional value to customers.

Frequently Asked Questions (FAQs)

Q. What is the definition of FinTech?

FinTech, short for Financial Technology, refers to the innovative use of technology to improve and transform financial services. It encompasses a wide range of digital applications, platforms, and services that aim to make financial processes more efficient, accessible, and user-friendly.

Q. Why are partnerships meaningful in the FinTech industry?

Partnerships are crucial in FinTech as they allow companies to leverage each other’s strengths and resources. By collaborating, FinTech startups and traditional financial institutions can drive innovation, share risks, access new markets, and create transformative solutions for customers.

Q. What are the benefits of FinTech partnerships?

FinTech partnerships offer several benefits, including accelerated innovation, enhanced customer experience, expanded product offerings, and the ability to address regulatory challenges. Partnerships enable companies to combine expertise, resources, and technologies to create more comprehensive and competitive solutions.

Q. What are the critical challenges in FinTech partnerships?

Challenges in FinTech partnerships include:

Overcoming these challenges requires effective communication, thorough planning, and collaboration to ensure successful partnerships.

Q. What is the future of FinTech partnerships?

The end of FinTech partnerships is promising, with trends such as cross-industry collaborations and a focus on customer-centricity. Partnerships between financial institutions and companies from other sectors will likely emerge, leading to innovative solutions catering to diverse customer needs. Additionally, data analytics, AI, and personalization will significantly shape future FinTech partnerships.

How Can Datavision help?

We assist various financial institutions and global banks on their digital transformation journey. Our one-of-a-kind approach, which combines people, process, and technology, expedites the delivery of superior results to our clients and drives excellence. Several reputed companies leverage our proprietary suite of business excellence tools and services to unlock new growth levers and unparalleled ROI.

Datavision stands proudly as a prominent banking software solutions provider, recognized for our unwavering commitment to excellence in the industry. We have earned our esteemed reputation by consistently delivering cutting-edge core banking software, catering to the needs of both retail and corporate banking software sectors. At Datavision, our mission is clear: to provide our clients with the best banking software products, ensuring that they stay ahead in an ever-evolving financial landscape. We take pride in serving our prestigious clients and look forward to continuing our journey of innovation and excellence.

Our portfolio of banking software product and services include:

Core Banking Solutions: | FinNext Core | Banking: | FinTrade | EasyLoan | MicroFin |

Digital Banking Solutions: | IBanc | MobiBanc | MBranch | FinTab | FinSight |

Risk & Compliance: |FinTrust |

Want to know how our team of experts at Datavision provides customizable, scalable, and cost-effective banking software products and solutions to our esteemed clients? Visit us for more information.