Introduction

The world of finance is undergoing a tremendous transformation driven by rapid technological advancements. Fintech, short for financial technology, has emerged as a disruptive force reshaping how we manage, invest, and transact with our money. In this comprehensive blog article, we will explore the fascinating world of fintech and its impact on the future of finance.

- What is Fintech?

Before we dive deeper into the future of finance, it is essential to understand what fintech is and how it has evolved over the years.

Fintech refers to integrating technology into financial services to make them more efficient, accessible, and customer centric. It encompasses many applications, from mobile payment solutions and peer-to-peer lending platforms to robo-advisors and blockchain-based cryptocurrencies.

The evolution of fintech can be divided into three distinct waves:

- The Early Wave (1950s-2000s): This phase saw the introduction of electronic trading, ATMs, and credit cards, which were significant advancements at the time. However, these innovations were focused on automating existing financial processes.

- The Internet Wave (Late 1990s-2000s): With the advent of the Internet, online banking and brokerage services became more prominent. Companies like PayPal and E*TRADE emerged, paving the way for greater convenience and accessibility in financial services.

- The Modern Wave (2010s-Present): This phase is characterized by the proliferation of smartphones, cloud computing, and big data analytics. It has given rise to various fintech startups and innovations fundamentally changing how we interact with money.

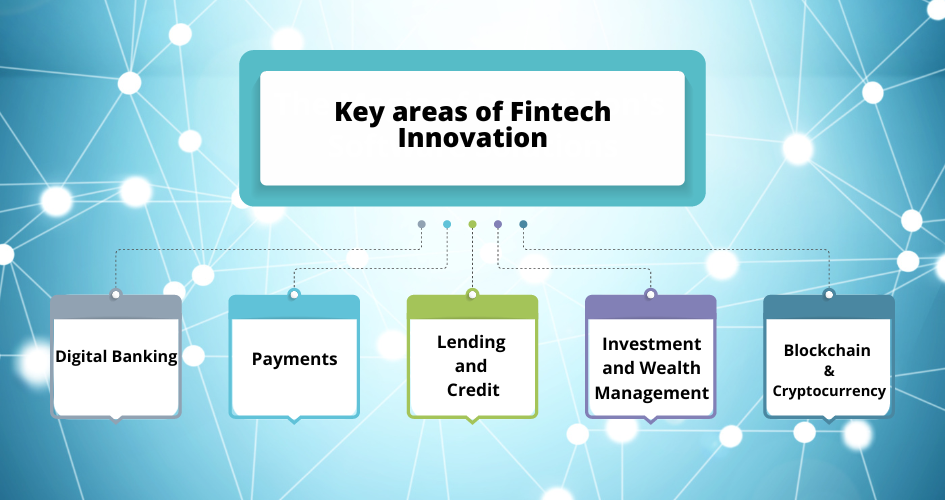

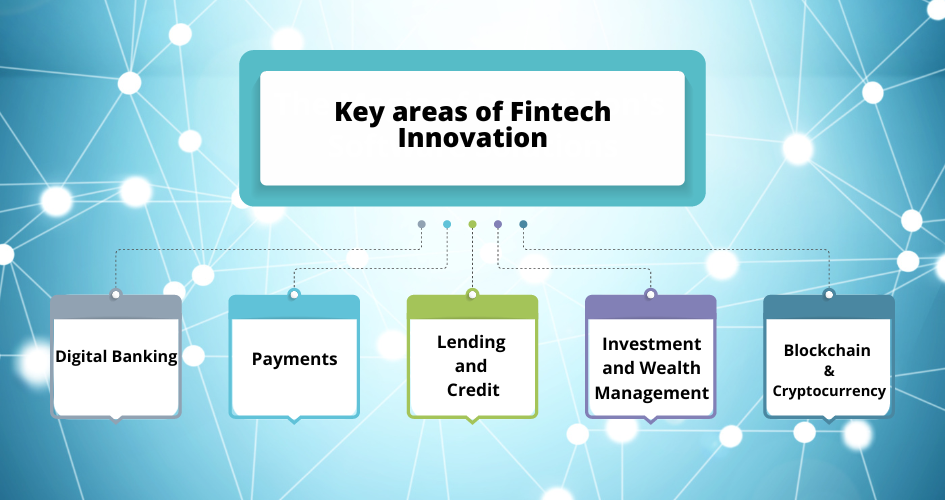

- Key Areas of Fintech Innovation

Fintech innovations have touched various aspects of finance, revolutionizing traditional banking, investing, and payments.

Let us explore some key areas of fintech innovation and how they are shaping the future of finance:

- Digital Banking

Traditional banks face stiff competition from digital-only banks, often called neo banks. These online-only institutions offer a seamless and user-friendly banking experience through mobile apps. Customers can open accounts, manage their finances, and access various financial products with just a few taps on their smartphones. Fintech-driven digital banks are gaining popularity, especially among millennials and Gen Z, for their low fees and innovative features.

- Payments

Fintech has revolutionized the way we make payments. Mobile payment platforms like Apple Pay, Google Pay, and Samsung Pay have made transactions more accessible and secure using smartphones. Additionally, peer-to-peer payment apps like Venmo and Cash App have transformed how we split bills and send money to friends and family.

- Lending and Credit

Fintech has disrupted the lending industry with the emergence of peer-to-peer (P2P) lending platforms and online lenders. These platforms connect borrowers directly with individual or institutional investors, cutting out the intermediary (banks) and potentially offering lower interest rates and faster approval processes. Furthermore, fintech has facilitated the development of credit scoring algorithms that consider alternative data sources, enabling more people to access credit, especially those without a traditional credit history.

- Investment and Wealth Management

Robo-advisors are a prime example of how fintech transforms investment and wealth management. These automated investment platforms use algorithms to create and manage diversified portfolios tailored to individual investor goals and risk profiles. Robo-advisors offer lower fees compared to traditional financial advisors and provide accessibility to a broader range of investors. Additionally, fintech has made it easier for retail investors to access the stock market through fractional shares and commission-free trading apps.

- Blockchain and Cryptocurrency

Blockchain technology, which underlies cryptocurrencies like Bitcoin, is revolutionizing various aspects of finance, including payments, identity verification, and supply chain management. The decentralized nature of blockchain ensures total transparency and security in financial transactions. Cryptocurrencies, while still relatively volatile and speculative, are gaining acceptance as alternative investments and even as a means of payment. Central banks are also exploring the concept of central bank digital currencies (CBDCs), which could further disrupt the traditional monetary system.

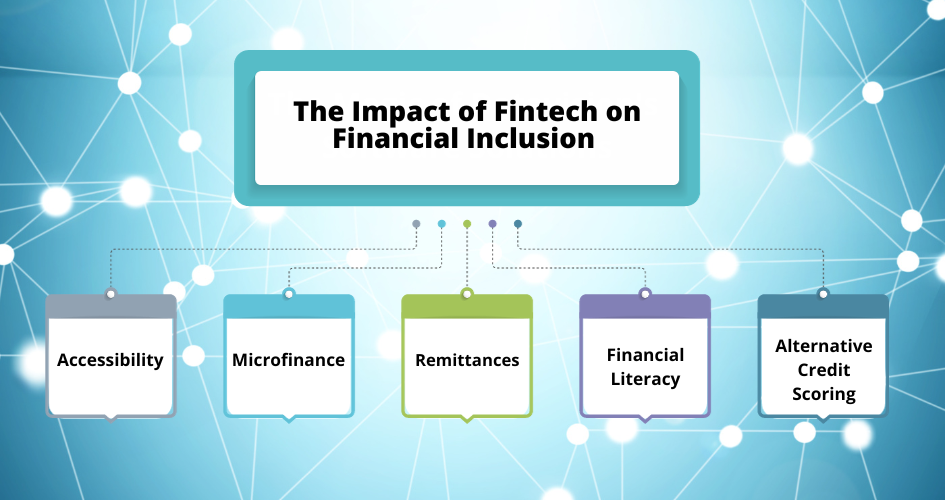

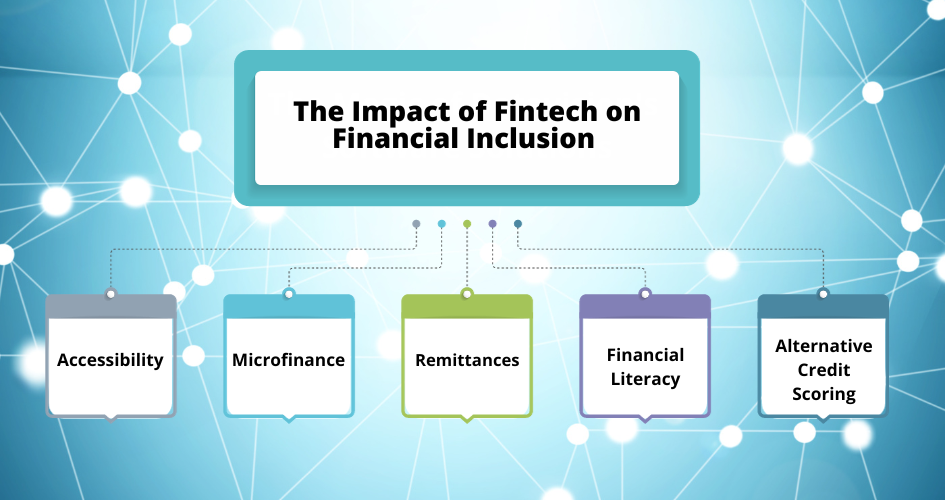

- The Impact of Fintech on Financial Inclusion

One of the most significant contributions of fintech to the future of finance is its potential to improve financial inclusion. For millions, traditional banking services have been inaccessible or expensive, particularly in underserved or remote areas. Fintech is bridging this gap by offering affordable and user-friendly financial solutions to a broader population.

Here’s how fintech is driving financial inclusion:

- Accessibility

Digital banking and mobile payment apps are accessible to anyone with a smartphone, providing financial services to individuals previously excluded from the banking system. It is particularly crucial in regions with limited access to physical bank branches. Fintech has increased access to financial services, particularly in areas where traditional banking infrastructure is lacking. Mobile banking apps and digital-only banks allow individuals to open accounts, make payments, and manage their finances using smartphones, bypassing physical bank branches.

- Microfinance

Fintech has enabled microfinance institutions to reach more borrowers in developing countries. Fintech platforms, such as peer-to-peer (P2P) lending and digital lending apps, facilitate microloans and small loans to entrepreneurs and individuals previously underserved by traditional banks. This access to credit can help individuals start or expand small businesses, contributing to economic growth.

- Remittances

Fintech-powered remittance services offer lower-cost alternatives, ensuring that more of the money sent reaches its intended recipients. Many migrant workers send money to their families in their home countries, often facing high fees and long processing times through traditional remittance services. Fintech-driven remittance platforms offer faster, cheaper, and more convenient cross-border money transfers, ensuring that more of the money sent reaches its intended recipients.

- Financial Literacy

Fintech apps and platforms often provide educational resources and tools to help users better understand their finances. It improves financial literacy, empowering individuals to make informed financial decisions. These resources can help individuals better understand how to manage their finances and plan for their futures.

- Alternative Credit Scoring

Traditional credit scoring models may exclude individuals without a credit history. Fintech innovations in alternative credit scoring consider a broader range of data, such as bill payments, rental history, and even social media behaviour. It allows more people to access credit and financial products.

- Regulatory Challenges and Security Concerns

While fintech holds great promise, it also presents regulatory challenges and security concerns that must be addressed as the industry evolves. Here are some key issues:

- Regulatory Compliance

Fintech companies frequently operate within a regulatory grey zone. as financial regulations were not designed with these modern technologies in mind. Governments worldwide are working to update regulations to ensure consumer protection, data security, and fair competition. They must comply with various national and international rules, which may have yet to be designed with their specific business models.

- Data Privacy

As fintech services become more diverse and accessible, there is an increasing need to protect consumers from fraud, mismanagement, and unfair practices. Regulators must balance fostering innovation and ensuring consumer rights are upheld. Fintech companies’ vast amounts of personal and financial data processing raise concerns about data privacy and security. Regulations like the European Union’s General Data Protection Regulation (GDPR) aim to protect individuals’ data rights, but data breaches remain a constant threat.

- Cybersecurity:

As fintech platforms become more prominent targets for cyberattacks, cybersecurity measures must be robust and continually updated to safeguard sensitive information and financial transactions. The growing reliance on digital platforms exposes fintech firms to cybersecurity risks, including hacking, phishing attacks, and malware. They must invest heavily in robust cybersecurity measures to protect against these threats.

- Financial Stability:

The rapid growth of fintech, especially in cryptocurrency, raises questions about its potential impact on financial stability. Regulatory bodies are closely monitoring these developments to mitigate systemic risks. As fintech companies grow, they must ensure that their security measures scale with their business. Rapid expansion can sometimes outpace the ability to maintain robust security practices.

- The Future of Finance: Opportunities and Challenges

The future of finance holds both exciting opportunities and significant challenges. Here is a comprehensive look at what lies ahead.

- Financial Ecosystem Integration

Fintech is driving the integration of various financial services within a single ecosystem. This integration can provide customers with a seamless, one-stop shop for banking, investment, insurance, and other financial needs. Customers will enjoy greater convenience, more personalized services, and potentially reduced costs as they navigate a unified financial ecosystem.

- AI (Artificial Intelligence) and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are poised to revolutionize finance. These technologies can analyze vast datasets, automate processes, and make predictions to enhance decision-making. AI and ML can improve risk assessment, fraud detection, customer service, and investment strategies. Investors can benefit from more accurate predictions and personalized investment recommendations.

- Central Bank Digital Currencies (CBDCs)

CBDCs are digital representations of a country’s national currency issued by the central bank. They have the potential to streamline cross-border transactions, reduce costs, and enhance financial inclusion. CBDCs can offer faster, more secure, and cost-effective international transactions, reducing the reliance on intermediaries like correspondent banks.

- Sustainability and Green Finance

The financial industry is increasingly focusing on sustainability and green finance. Investments in environmentally friendly projects and companies are on the rise. Investors can support sustainable and socially responsible initiatives to align their portfolios with their values, potentially promoting positive environmental and social outcomes.

- Financial Education

The proliferation of fintech tools and services also provides an opportunity to improve financial literacy. Fintech platforms can include educational resources to help users better understand their finances. Those who possess financial literacy experience better decision-making, effective management of funds, and successful financial goal attainment.

Challenges

- Regulation and Oversight

Regulators must balance fostering fintech innovation and protecting consumers and the financial system. Developing and adapting regulations to keep pace with technological advancements is challenging. Overregulation can stifle innovation, while under regulation can lead to risks for consumers and systemic instability.

- Data Privacy and Security

Fintech companies handle vast amounts of personal and financial data. Ensuring the privacy and security of this data is a significant challenge, especially in the face of evolving cyber threats. Data breaches may cause financial losses, identity theft, and harm a company’s reputation.

- Digital Divide

While fintech has the potential to enhance financial inclusion, the digital divide remains a challenge. Only some people have access to the necessary technology or internet connectivity. The digital divide can exacerbate existing inequalities, leaving specific populations behind in terms of financial services and opportunities.

- Systemic Risks

The rapid growth of fintech, especially in cryptocurrency, raises concerns about potential systemic risks. These risks need to be carefully monitored and managed. Systemic risks could lead to financial instability and disruptions in the broader economy.

- Ethical and Legal Considerations: Using AI and automation in finance brings ethical and legal considerations, particularly in algorithmic bias, accountability, and transparency. Ethical lapses and legal issues can erode trust in financial institutions and lead to regulatory actions.

Conclusion

Fintech is reshaping the future of finance, offering greater accessibility, efficiency, and innovation in financial services. From digital banking and mobile payments to blockchain-based cryptocurrencies and robo-advisors, fintech transforms how we manage and interact with our money. However, this transformation has challenges, including regulatory compliance, data security, and ethical concerns.

It is important to balance innovation and regulation in fintech to protect consumers and the financial system’s stability. The future of finance promises to be exciting and dynamic, with fintech at its forefront, driving progress and reshaping how we think about money and financial services.

How Can Datavision help?

We assist various financial institutions and global banks on their digital transformation journey. Our one-of-a-kind approach, which combines people, process, and technology, expedites the delivery of superior results to our clients and drives excellence. Several reputed companies leverage our proprietary suite of business excellence tools and services to unlock new growth levers and unparalleled ROI.

Datavision stands proudly as a prominent banking software solutions provider, recognized for our unwavering commitment to excellence in the industry. We have earned our esteemed reputation by consistently delivering cutting-edge core banking software, catering to the needs of both retail and corporate banking software sectors. At Datavision, our mission is clear: to provide our clients with the best banking software products, ensuring that they stay ahead in an ever-evolving financial landscape. We take pride in serving our prestigious clients and look forward to continuing our journey of innovation and excellence.

Our portfolio of banking software product and services include:

Core Banking Solutions: | FinNext Core | Banking: | FinTrade | EasyLoan | MicroFin |

Digital Banking Solutions: | IBanc | MobiBanc | MBranch | FinTab | FinSight |

Payments: | FinPay |

Risk & Compliance: |FinTrust |

Want to know how our team of experts at Datavision provides customizable, scalable, and cost-effective banking software products and solutions to our esteemed clients? Visit us for more information.