Pioneering Environmental Responsibility with Innovative Banking Solutions

In an era where environmental consciousness is rapidly becoming a primary concern for individuals, businesses, and governments alike, sustainable banking has emerged as a groundbreaking paradigm shift within the financial services sector. Green and sustainable banking integrates environmental, social, and governance (ESG) factors into banking operations, products, and services. This transformative approach reflects the industry’s commitment to environmental responsibility and underscores the potential of innovative banking solutions to drive positive change.

The Essence of Sustainable Banking

The essence of sustainable banking lies in its ability to align financial practices with the principles of environmental responsibility. This shift transcends mere corporate social responsibility; it redefines the banking sector’s role as a catalyst for sustainability. Sustainable banking involves proactive measures to minimize the carbon footprint of banking operations, facilitate eco-friendly lending practices, and support environmentally conscious investments.

Traditional banking models often prioritize short-term gains and profit margins, sometimes at the expense of environmental considerations. Sustainable banking, however, introduces a long-term perspective that balances economic growth with ecological well-being. The digital revolution within banking can be harnessed to amplify the impact of sustainable practices, leading to a mutually beneficial relationship between digital innovation and environmental stewardship.

The Nexus of Digital Banking and Environmental Sustainability

Digital banking has emerged as a potent driver of both convenience and sustainability. Digital banking solutions enable customers to adopt environmentally friendly practices effortlessly. Reduced paper usage through electronic statements, online bill payments, and mobile banking applications reduces the industry’s carbon footprint. Additionally, digital channels allow banks to educate customers about sustainable financial decisions and incentivize eco-conscious behaviours.Furthermore, the digital transformation of banking operations optimizes resource utilization and energy consumption within the banking infrastructure. Automated processes, data-driven insights, and cloud-based platforms minimize waste and enhance operational efficiency. It contributes to cost savings and positions banks as champions of environmental conservation.

Nurturing Sustainability through Innovative Products

Sustainable banking goes beyond operational changes and extends to the core of banking products and services. “What is Sustainable Banking? Underscores the significance of offering innovative financial products that fund environmentally sustainable projects. Green bonds, for instance, raise capital for initiatives aimed at renewable energy, climate adaptation, and sustainable infrastructure. These financial instruments allow investors to participate in projects that yield both financial returns and ecological benefits.

Moreover, sustainable banking involves integrating ESG considerations into credit assessments. This approach ensures that loans are extended to projects and businesses aligned with sustainable practices. Banks play a pivotal role in shaping a more sustainable future by evaluating borrowers’ commitment to environmental and social responsibility.

Collaborative Partnerships for Lasting Impact

The transition towards green and sustainable banking necessitates collaboration among banks, governments, regulators, and non-governmental organizations (NGOs). Regulatory frameworks that incentivize sustainable lending practices can catalyze industry-wide change. Additionally, partnerships with NGOs and environmental experts offer banks access to specialized knowledge, fostering the development of innovative solutions that address pressing ecological challenges.

Collaborative platforms enable the exchange of best practices, exploring innovative ideas, and pooling resources to drive meaningful change. This collaborative approach amplifies the impact of sustainable banking beyond individual institutions, leading to a more resilient and environmentally conscious financial sector.

Overcoming Challenges and Seizing Opportunities

While the path to green and sustainable banking is marked by immense promise, it has challenges. Navigating the complexities of sustainable finance requires banks to integrate ESG considerations seamlessly into their decision-making processes. It demands robust data analytics, innovative technology, and skilled personnel who can evaluate the environmental impact of financial activities.

Moreover, the adoption of sustainable practices necessitates cultural shifts within banking organizations. A commitment to sustainability must be embedded in the institution’s values and operational policies. Training and awareness programs can foster a culture of environmental consciousness, empowering employees to champion sustainable practices within and outside the workplace.

Advantages of Green and Sustainable Banking

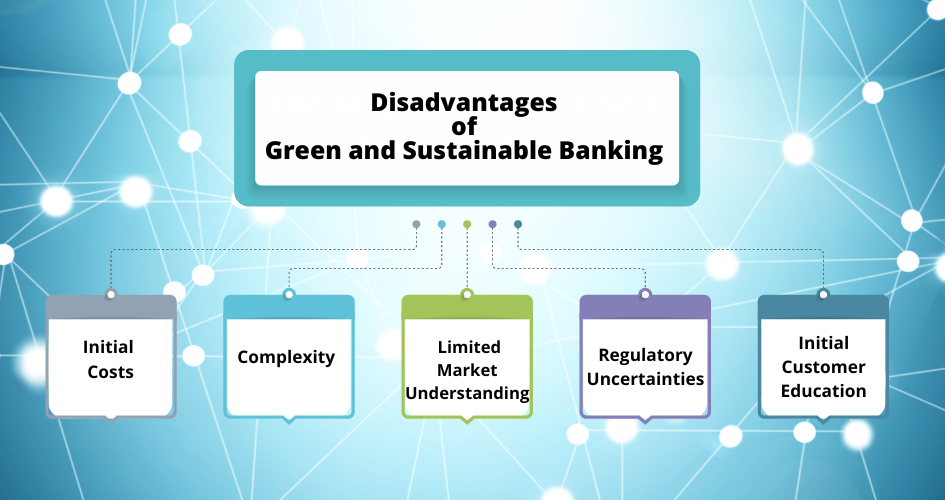

Disadvantages of Green and Sustainable Banking

Banks need to be more active in embracing sustainability measures than other industries. However, the campaign for sustainable banking is gaining traction and will intensify over the next ten years.

At this critical point in the transition to sustainability, there are a few major areas where banks may accelerate their efforts to become more ecologically responsible:

Developing a Long-Term Banking Strategy: Create a clear sustainability plan and take actionable efforts to achieve it. Conduct a thorough investigation to help guide your transition to a socially responsible bank. Determine the business strategy and technologies required to capitalize on this potential and how you will give value to your clients.

Managing Risk and Regulatory Compliance: The landscape of ESG (Environmental, Social, and Governance) legislation is fast growing, encompassing social and governance concerns and climate change. While some requirements, such as climate stress testing and sustainability disclosures, are already in place, greater filtration of lending practices based on established taxonomies will follow. Banks should plan ahead of time for potential regulatory changes. Handling ESG-related risk entails more than just reporting; it needs a fundamental shift in risk management throughout the organization.

Providing Sustainable Products: Banks are already attempting to gain a competitive advantage in sustainable finance by developing new products such as green bonds, sustainable mortgages, and eco-conscious loans. This push for green solutions will have a knock-on effect across other industries, driving more adoption of sustainable practices. While banks are under pressure right now, ESG-linked products can be beneficial in both lending and investing. Banks must build streamlined solutions with efficient process frameworks and technical architecture to support these activities.

Implementing a Strategic Operating Model: The impact of ESG may be seen in many elements of bank operating models, including front and back offices. Sustainable financial decision-making, ESG due diligence for clients, investment guidance, and supply chain finance are all becoming more important. As ESG standards and taxonomies evolve, ESG analysts’ efforts will increase. It is critical to incorporate ESG data into client lifecycle management, expanding on existing KYC (Know Your Customer) and AML (Anti-Money Laundering) processes.

Green IT Initiatives: Improve operational efficiency by transferring apps, data, and infrastructure to the cloud, which provides the added benefit of lowering carbon emissions and operational expenses. Approaching cloud migration from a sustainability standpoint can dramatically reduce global carbon emissions, contributing significantly to climate change pledges.

However, it is a task that necessitates the proper approach. Banks that quickly develop and implement their sustainability agendas will gain an advantage as pioneers aiming to meet, if not exceed, their sustainability objectives. The time has come to act.

Conclusion

Green and sustainable banking represents a monumental shift in the financial services industry, signalling a departure from profit-focused moves towards ecological responsibility.

By integrating ESG factors into banking operations, harnessing the power of digital innovation, offering innovative products, and forging collaborative partnerships, banks are contributing to environmental sustainability and positioning themselves as pioneers of positive change.

As the world grapples with environmental challenges, the banking sector’s transformation towards sustainability serves as a beacon of hope. By embracing this shift, banks can drive lasting impact, foster economic growth, and become catalysts for a greener, more sustainable future.

FAQs (Frequently Asked Questions) about Green and Sustainable Banking

Q1: What is the difference between sustainable banking and traditional banking?

Ans. Sustainable banking integrates environmental, social, and governance factors into decision-making, while traditional banking often focuses solely on financial profitability.

Q2: How can digital banking support green initiatives?

Ans. Digital banking reduces paper usage, streamlines operations, and facilitates customer educational campaigns, promoting eco-conscious behaviours.

Q3: What are green bonds?

Ans. Green bonds are financial instruments that raise capital for environmentally friendly projects, offering investors the chance to support sustainability while earning returns.

Q4: How do banks ensure the authenticity of their sustainable practices?

Ans. Many banks obtain third-party certifications to validate their sustainable initiatives, enhancing transparency and trust.

Call to Action: Nurturing a Greener Banking Future

The path to a more sustainable banking sector requires collective effort. To drive meaningful change, banks, regulators, and customers must collaborate:

How Can Datavision help?

We assist various financial institutions and global banks on their digital transformation journey. Our one-of-a-kind approach, which combines people, process, and technology, expedites the delivery of superior results to our clients and drives excellence. Several reputed companies leverage our proprietary suite of business excellence tools and services to unlock new growth levers and unparalleled ROI.

Datavision stands proudly as a prominent banking software solutions provider, recognized for our unwavering commitment to excellence in the industry. We have earned our esteemed reputation by consistently delivering cutting-edge core banking software, catering to the needs of both retail and corporate banking software sectors. At Datavision, our mission is clear: to provide our clients with the best banking software products, ensuring that they stay ahead in an ever-evolving financial landscape. We take pride in serving our prestigious clients and look forward to continuing our journey of innovation and excellence.

Our portfolio of banking software product and services include:

Core Banking Solutions: | FinNext Core | Banking: | FinTrade | EasyLoan | MicroFin |

Digital Banking Solutions: | IBanc | MobiBanc | MBranch | FinTab | FinSight |

Risk & Compliance: |FinTrust |

Want to know how our team of experts at Datavision provides customizable, scalable, and cost-effective banking software products and solutions to our esteemed clients? Visit us for more information.