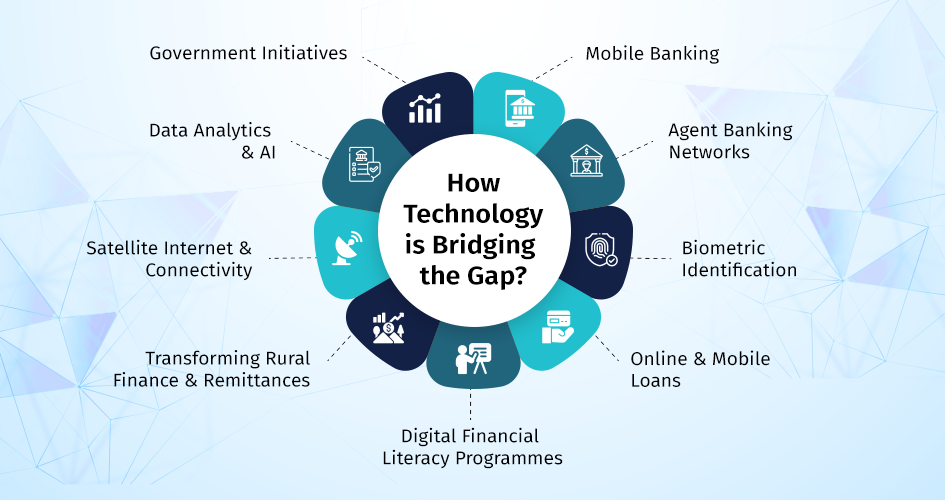

Bridging the Gap: How Technology is Revolutionizing Financial Inclusion for Underserved Communities

Access to financial services is essential for economic development and reduction of poverty. Technology is revolutionizing financial inclusion for underserved communities. Unfortunately, millions of disadvantaged and rural people worldwide lack essential banking services. Technology has provided fresh solutions to this problem. In this blog, let us explore ways technology can deliver inclusive financial services to marginalized communities.

Mobile Banking: Mobile banking and digital wallets have become revolutionary tools to promote financial inclusion, especially in rural areas where traditional banks are sparse. These digital advancements have democratized financial services, allowing people to manage the complex financial world with smartphones. A New Frontier Access to financial services was hard for rural people for decades. Geographic isolation and a lack of banking infrastructure aggravate these issues. Mobile banking and digital wallets have closed this gap, enabling financial inclusion.

A key aspect of digital tools is their ability to empower individuals. Rural residents can now make many financial activities from home without being limited by geography. Digital wallets and mobile banking apps provide secure and convenient payment transactions with smartphones and appropriate software. Users may quickly pay utility bills, buy things, and access services with a few clicks.

Transferring funds to distant family members or getting remittances from metropolitan regions is now easy. Mobile banking apps allow fast fund transfers, saving time and money on cash deposits and withdrawals. Mobile banking and digital wallets enable access to critical financial services beyond basic transactions, like savings accounts and credit facilities. Small enterprises can use credit lines to grow and stabilize, while rural entrepreneurs can save for emergencies or investments.

Agent Banking Networks: By bridging the financial divide in remote regions, agent banking networks have become a significant innovation for financial inclusion. This paradigm shift in banking uses agents with mobile devices and card readers to provide essential financial services to unbanked and underbanked people in rural and ignored locations.

Agent Banking Networks: By bridging the financial divide in remote regions, agent banking networks have become a significant innovation for financial inclusion. This paradigm shift in banking uses agents with mobile devices and card readers to provide essential financial services to unbanked and underbanked people in rural and ignored locations.

Before Financial Inclusion, remote residents faced significant obstacles in accessing financial services. Their vastness and lack of bank branches worsened the challenges in rural areas. A powerful answer to this old problem, agent banking networks provide hope to those excluded from the traditional financial system. At the core of agent banking networks are agents who act as financial envoys for neglected areas. Agents with mobile devices and card readers can handle various financial transactions. They connect rural populations to formal financial institutions by turning mobile devices into virtual bank branches.

In the future, agent banking networks will look for potential. These networks will grow as technology advances with advanced mobile banking solutions, better agent training, and greater coordination between financial institutions, governments, and fintech startups. By solving agent banking’s issues and grasping its benefits, we can achieve total financial inclusion and ensure that every community is included in the global financial landscape.

Biometric identification: Biometric identification is a transformative tool for achieving financial inclusion, especially in underserved areas where traditional identification documents are scarce. This innovative identity verification technology uses biometric markers like fingerprints or iris scans to verify identity securely and efficiently.

Biometric identification: Biometric identification is a transformative tool for achieving financial inclusion, especially in underserved areas where traditional identification documents are scarce. This innovative identity verification technology uses biometric markers like fingerprints or iris scans to verify identity securely and efficiently.

Acquiring traditional identification documents like passports or driver’s licenses can be difficult in remote and impoverished places. Bureaucratic impediments, lack of documentation infrastructure, or excessive certification prices can cause these obstacles. Large parts of the population are excluded from the formal financial system and need more banking access.

Biometric identity technologies provide a secure and inclusive solution to this widespread issue. Individuals can accurately identify themselves using fingerprints, iris patterns, or facial recognition. These safe solutions do not discriminate against people without IDs, making them inclusive.

Online & Mobile Loans: Providing access to finance through online and mobile loans can revolutionize rural communities by promoting entrepreneurship, economic growth, and financial stability. Limited access to traditional financial institutions and credit providers can be a significant economic barrier for rural populations. Rural populations need help to get loans for farming, small companies, education, and emergencies due to traditional lending methods that require collateral or a good credit history.

Online & Mobile Loans: Providing access to finance through online and mobile loans can revolutionize rural communities by promoting entrepreneurship, economic growth, and financial stability. Limited access to traditional financial institutions and credit providers can be a significant economic barrier for rural populations. Rural populations need help to get loans for farming, small companies, education, and emergencies due to traditional lending methods that require collateral or a good credit history.

Online and Mobile Lending Platforms offer innovative methods to alleviate credit gaps. These platforms are revolutionizing rural finance by delivering loans online or through mobile apps, promoting accessibility beyond geographic obstacles. Rural dwellers can now get credit without traveling far.

Digital Financial Literacy Programmes: Empowering Rural Communities with Financial Knowledge Financial literacy is essential for economic development, particularly in rural communities with limited financial resources. Digital financial literacy programs have arisen to close this information gap and empower underprivileged rural populations to make intelligent financial decisions.

Digital Financial Literacy Programmes: Empowering Rural Communities with Financial Knowledge Financial literacy is essential for economic development, particularly in rural communities with limited financial resources. Digital financial literacy programs have arisen to close this information gap and empower underprivileged rural populations to make intelligent financial decisions.

When resources and opportunities are rare, financial literacy is crucial for individuals’ economic well-being in rural communities. Rural households gain knowledge and abilities to manage income, budget appropriately, optimize revenue, and prepare for long-term financial goals.

Transforming Rural Finance and Remittances: Blockchain and Cryptocurrencies Blockchain technology and cryptocurrencies have revolutionized financial services, especially in rural areas with limited access to traditional banks. These developments have provided secure, affordable banking choices for remote migrant workers and their families. Decentralized finance (DeFi) platforms are also replacing banks in financial services.

Transforming Rural Finance and Remittances: Blockchain and Cryptocurrencies Blockchain technology and cryptocurrencies have revolutionized financial services, especially in rural areas with limited access to traditional banks. These developments have provided secure, affordable banking choices for remote migrant workers and their families. Decentralized finance (DeFi) platforms are also replacing banks in financial services.

Revolutionising Cross-Border Payments and Remittances Rural areas, particularly those with a large migrant worker population, rely on cross-border remittances for survival. Historically, these transactions had significant costs and long processing periods.

Satellite Internet and Connectivity: Bridging the Digital Divide in Rural Finance In today’s digital age, internet access is essential for accessing various financial services. In rural locations without traditional internet infrastructure, satellite internet and related solutions are necessary for remote communities to engage in the digital financial ecosystem.Rural Finance: The Digital Divide Historically, rural communities have had limited access to reliable Internet services. The difference hinders access to critical financial assistance and reinforces economic inequality. Satellite internet and connection options are changing this picture substantially.

Satellite Internet and Connectivity: Bridging the Digital Divide in Rural Finance In today’s digital age, internet access is essential for accessing various financial services. In rural locations without traditional internet infrastructure, satellite internet and related solutions are necessary for remote communities to engage in the digital financial ecosystem.Rural Finance: The Digital Divide Historically, rural communities have had limited access to reliable Internet services. The difference hinders access to critical financial assistance and reinforces economic inequality. Satellite internet and connection options are changing this picture substantially.

Satellite internet is a game-changer for rural communities, giving internet connectivity where traditional broadband infrastructure is costly or difficult to construct. Satellite internet alters rural banking by providing ubiquitous access regardless of geography. It sends internet signals to faraway areas, connecting rural populations to the internet.

Government initiatives: Government initiatives have a crucial role in fostering financial inclusion, particularly in underserved regions, as they shape the financial environment of their nations. Governments can promote inclusive finance, economic growth, and inequality reduction through strategic policies, digital payment systems, subsidy programs, and financial institution incentives. Government leadership is crucial for financial inclusion, economic development, and social equality. Governments recognize the need to provide financial services to all residents, regardless of location or income. Thus, they are increasingly proactive in leveling the playing field. Government efforts strive to promote financial inclusion through various tactics and interventions, such as digital payment systems, which governments often develop and implement. Mobile wallets and government-backed payment apps allow citizens, particularly remote ones, to quickly make digital transactions, receive subsidies, and access financial services.

Government initiatives: Government initiatives have a crucial role in fostering financial inclusion, particularly in underserved regions, as they shape the financial environment of their nations. Governments can promote inclusive finance, economic growth, and inequality reduction through strategic policies, digital payment systems, subsidy programs, and financial institution incentives. Government leadership is crucial for financial inclusion, economic development, and social equality. Governments recognize the need to provide financial services to all residents, regardless of location or income. Thus, they are increasingly proactive in leveling the playing field. Government efforts strive to promote financial inclusion through various tactics and interventions, such as digital payment systems, which governments often develop and implement. Mobile wallets and government-backed payment apps allow citizens, particularly remote ones, to quickly make digital transactions, receive subsidies, and access financial services.

Data Analytics & AI: In the digital era, powerful data analytics and AI are transforming the accessibility and cost of financial services for underserved populations. These technologies allow financial organizations to accurately assess credit risk, detect fraud, and adapt financial offerings to underrepresented communities. Data analytics and AI technologies are robust due to the large volumes of data collected in the digital age. Using this data, financial institutions can assess credit risk using AI-driven algorithms that incorporate transaction histories, spending habits, and social media activity. Lenders can lend to people without credit histories.

Data Analytics & AI: In the digital era, powerful data analytics and AI are transforming the accessibility and cost of financial services for underserved populations. These technologies allow financial organizations to accurately assess credit risk, detect fraud, and adapt financial offerings to underrepresented communities. Data analytics and AI technologies are robust due to the large volumes of data collected in the digital age. Using this data, financial institutions can assess credit risk using AI-driven algorithms that incorporate transaction histories, spending habits, and social media activity. Lenders can lend to people without credit histories.

Collaboration between traditional financial institutions and fintech startups combines their strengths, combining banks’ infrastructure, resources, and regulatory experience with startups’ innovation, agility, and technology prowess. Fintech entrepreneurs leverage innovative ideas and disruptive technologies to co-create customized financial products and services for underprivileged areas.

Technology has enormous potential to improve financial inclusion in rural and neglected areas. Mobile banking, biometrics, blockchain, and other innovations make financial services accessible to the disenfranchised. Governments, financial institutions, and tech entrepreneurs must collaborate to help everyone achieve financial inclusion, empower communities, and boost global economic growth.

Conclusion: Financial inclusion is not merely a technological challenge; it’s a social and economic imperative. Moving forward, collaboration between governments, financial institutions, technology providers, and civil society organizations is crucial. By prioritizing responsible innovation, user-centric design, and targeted capacity building, we can harness the power of technology to build a more inclusive financial system where everyone has equal access to the tools and resources to build a better future.

This journey towards true financial inclusion will require not just technological advancements but also a fundamental shift in mindsets. We must move beyond viewing financial services as mere products and recognize them as essential tools for empowerment, resilience, and sustainable development.

Ultimately, it’s about ensuring that everyone, regardless of background or circumstance, has the opportunity to participate in the financial realm, build wealth, and secure a brighter future. When we bridge the gap and create a financially inclusive world, we not only pave the path for individual prosperity but also unlock the full potential of our collective economic and social progress.

How Can Datavision help?

We assist various financial institutions and global banks on their digital transformation journey. Our one-of-a-kind approach, which combines people, process, and technology, expedites the delivery of superior results to our clients and drives excellence. Several reputed companies leverage our proprietary suite of business excellence tools and services to unlock new growth levers and unparalleled ROI.

Datavision stands proudly as a prominent banking software solutions provider, recognized for our unwavering commitment to excellence in the industry. We have earned our esteemed reputation by consistently delivering cutting-edge core banking software, catering to the needs of both retail and corporate banking software sectors. At Datavision, our mission is clear: to provide our clients with the best banking software products, ensuring that they stay ahead in an ever-evolving financial landscape. We take pride in serving our prestigious clients and look forward to continuing our journey of innovation and excellence.

Our portfolio of banking software product and services include:

Core Banking Solutions: | FinNext Core | Banking: | FinTrade | EasyLoan | MicroFin |

Digital Banking Solutions: | IBanc | MobiBanc | MBranch | FinTab | FinSight |

Risk & Compliance: |FinTrust |

Want to know how our team of experts at Datavision provides customizable, scalable, and cost-effective banking software products and solutions to our esteemed clients? Visit us for more information.