Improving Trade Finance Operations through Technology

Trade finance is pivotal in global commerce, enabling businesses to bridge the gap between suppliers and buyers, ensuring smooth cross-border transactions. However, traditional trade finance processes often fall short due to inefficiencies, excessive costs, and outdated practices. Enter technology—an enabler of transformation and efficiency. From blockchain to artificial intelligence, technology is revolutionizing trade finance, driving innovation and removing barriers hindering growth.

The Current Challenges in Trade Finance

1. Lack of Transparency

1. Lack of Transparency

In traditional trade finance, a significant challenge is the lack of visibility across the entire value chain. Stakeholders, including banks, exporters, and importers, often work in silos, leading to limited access to real-time data. This opacity can result in delayed decision-making, mistrust, and disputes.

2. Paper-Based Processes

2. Paper-Based Processes

Trade finance is historically paper-heavy, relying on physical documentation such as letters of credit, bills of lading, and invoices. These documents can be easily lost, forged, or mishandled, increasing the risk of errors and fraud. Moreover, processing physical documents is time-consuming, further slowing down transactions.

3. High Costs and Inefficiencies

3. High Costs and Inefficiencies

Manual processes and reliance on intermediaries increase transaction costs. Moreover, workflow inefficiencies, redundant processes, and communication breakdowns amplify operational expenses, making trade finance inaccessible for smaller businesses.

4. Fragmented Communication

4. Fragmented Communication

Communication gaps between stakeholders, including banks, insurers, and freight companies, create bottlenecks in the system. This fragmentation leads to delays in approvals, incomplete information sharing, and increased risk of errors.

How Technology is Reshaping Trade Finance

Technology addresses these challenges by streamlining processes, enhancing collaboration, and increasing transparency. Let us dive deeper into the technological advancements transforming the trade finance ecosystem.

Blockchain in Trade Finance

What is Blockchain Technology?

What is Blockchain Technology?

Blockchain is a decentralized ledger that securely records transactions in a transparent and immutable manner. By eliminating the need for intermediaries, blockchain enhances trust and efficiency.

Benefits of Blockchain in Trade Finance

Benefits of Blockchain in Trade Finance

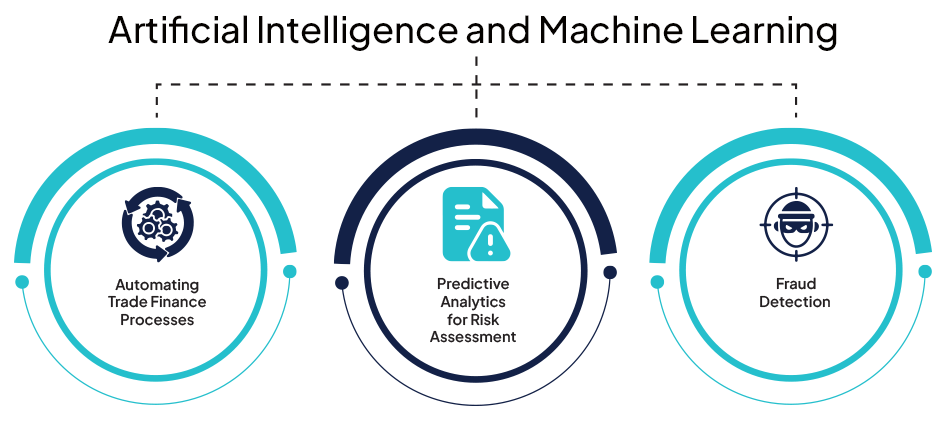

Artificial Intelligence and Machine Learning:

Automating Trade Finance Processes

AI-powered tools automate labour-intensive processes such as document verification, data entry, and compliance checks. This reduces manual errors and accelerates transaction timelines.

Predictive Analytics for Risk Assessment

AI and machine learning algorithms analyse historical and real-time data to predict potential risks. For instance, they can identify creditworthiness, detect patterns indicating financial distress, and provide recommendations for risk mitigation.

Fraud Detection

AI-driven systems can identify unusual patterns or anomalies in transactions, flagging potential fraud. This proactive approach strengthens security and minimizes financial losses.

Digital Platforms and Paperless Trade:

Centralized Digital Platforms

Digital platforms bring all stakeholders under one roof, enabling seamless communication and collaboration. Platforms like Bolero and Ess DOCS lead digital document exchange, ensuring faster processing.

Benefits of Paperless Trade

Smart Contracts in Trade Finance:

What Are Smart Contracts?

Smart contracts are self-executing agreements written in code and deployed on a blockchain. These contracts automatically enforce terms and conditions when predefined criteria are met.

Applications in Trade Finance

Benefits of Smart Contracts

IoT and Supply Chain Integration:

The Role of IoT in Trade Finance

The Role of IoT in Trade Finance

The Internet of Things (IoT) enables real-time tracking and monitoring of goods throughout the supply chain. IoT devices, such as GPS trackers and RFID tags, provide visibility into shipment conditions, routes, and delivery times.

How IoT Enhances Trade Finance

How IoT Enhances Trade Finance

Cloud Computing in Trade Finance:

Why Cloud-Based Solutions?

Why Cloud-Based Solutions?

Cloud computing enables businesses to store, access, and manage data in real-time, reducing the need for physical infrastructure.

Key Benefits

Key Benefits

Digital Payment Solutions:

Cross-Border Payment Advancements

Cross-Border Payment Advancements

Digital payment systems like FinPay, SWIFT GPI, PayPal, and Ripple Net are revolutionizing cross-border transactions. These platforms enable faster, secure, and transparent payments, eliminating delays caused by traditional banking systems.

Benefits

Benefits

Regulatory Technology (RegTech):

What is RegTech?

RegTech leverages technology to streamline compliance processes, ensuring businesses adhere to regulatory requirements.

Applications in Trade Finance

Benefits of Technology in Trade Finance:

Cost Reduction

Automating processes and eliminating intermediaries significantly lowers transaction costs.

Improved Efficiency

Digital solutions accelerate trade finance operations, enabling businesses to process transactions in hours instead of days.

Enhanced Risk Management

Technologies like AI and blockchain provide robust tools for risk mitigation, fraud detection, and compliance.

Future Trends in Trade Finance Technology:

Decentralized Finance (DeFi)

DeFi platforms are emerging as alternatives to traditional financing, enabling peer-to-peer trade finance without intermediaries.

AI-Driven Predictive Analytics

Advanced AI systems will continue to revolutionize risk assessment and decision-making.

Increased Paperless Adoption

Governments and international organizations are pushing for the widespread adoption of digital trade documents.

Conclusion

Technology has undeniably become a game-changer in trade finance. Addressing challenges such as inefficiencies, inflated costs, and lack of transparency has paved the way for a more streamlined and secure system. For businesses looking to stay competitive in today’s global marketplace, embracing these technological advancements isn’t just an option—it is a necessity.

FAQs

How Can Datavision help?

We assist various financial institutions and global banks on their digital transformation journey. Our one-of-a-kind approach, which combines people, process, and technology, expedites the delivery of superior results to our clients and drives excellence. Several reputed companies leverage our proprietary suite of business excellence tools and services to unlock new growth levers and unparalleled ROI.

Datavision stands proudly as a prominent banking software solutions provider, recognized for our unwavering commitment to excellence in the industry. We have earned our esteemed reputation by consistently delivering cutting-edge core banking software, catering to the needs of both retail and corporate banking software sectors. At Datavision, our mission is clear: to provide our clients with the best banking software products, ensuring that they stay ahead in an ever-evolving financial landscape. We take pride in serving our prestigious clients and look forward to continuing our journey of innovation and excellence.

Our portfolio of banking software product and services include:

Core Banking Solutions: | FinNext Core | Banking: | FinTrade | EasyLoan | MicroFin |

Digital Banking Solutions: | IBanc | MobiBanc | MBranch | FinTab | FinSight |

Risk & Compliance: |FinTrust |

Want to know how our team of experts at Datavision provides customizable, scalable, and cost-effective banking software products and solutions to our esteemed clients? Visit us for more information.