Peer-to-Peer Lending Platforms: Disrupting Traditional Loan Processes

Peer-to-peer lending has completely changed how people and businesses borrow and lend money in the Financial industry, disrupting established Banking institutions. This article will examine the different facets of this phenomenon, including its causes, advantages, difficulties, and potential future developments.

The Emergence of Peer-to-Peer Lending

The emergence of peer-to-peer lending has completely transformed the banking industry, significantly shaking up conventional Banking institutions and fundamentally changing the borrowing and lending landscape for individuals and businesses. This section will explore the different aspects of this phenomenon, including its origins, advantages, difficulties, and prospects.

Origins: Peer-to-peer lending, also referred to as P2P lending or marketplace lending, emerged in the early 2000s as an alternative to traditional banking systems. It became popular during the global Banking crisis 2008 when banks implemented stricter lending criteria, making many borrowers unable to access credit. Through online marketplaces, P2P lending platforms bridged this void by facilitating direct connections between borrowers and individual lenders.

Advantages for Borrowers: Accessibility is a significant benefit of peer-to-peer lending. Traditional banks typically have strict criteria that may prevent specific individuals or businesses from qualifying for loans. P2P lending platforms provide a more inclusive approach, enabling borrowers with different credit profiles to access funds at competitive interest rates. In addition, the efficient online application process and expedited approval times make it a compelling choice for individuals seeking prompt financing.

Benefits for Lenders: Peer-to-peer lending allows individuals to invest their money and take advantage of unique opportunities. By eliminating the need for middlemen, lenders have the opportunity to achieve more lucrative returns on their investments than conventional savings accounts or bonds. P2P platforms allow lenders to diversify their portfolios by allocating their investments among numerous borrowers with different levels of risk.

Challenges and Risks: Despite its numerous benefits, peer-to-peer lending comes with its fair share of challenges. One of the primary considerations for lenders is the potential for borrowers to default. Compared to traditional banks, P2P platforms may have different levels of resources to conduct thorough credit checks or collateral assessments. Therefore, lenders must thoroughly evaluate borrowers’ profiles and assess the risks involved.

Exploring Peer-to-Peer Lending Platforms

Peer-to-peer lending platforms have revolutionized the Banking industry by providing a new approach to lending and borrowing money and transforming how individuals and businesses access loans. These platforms facilitate direct connections between borrowers and lenders, bypassing traditional Banking intermediaries like banks.

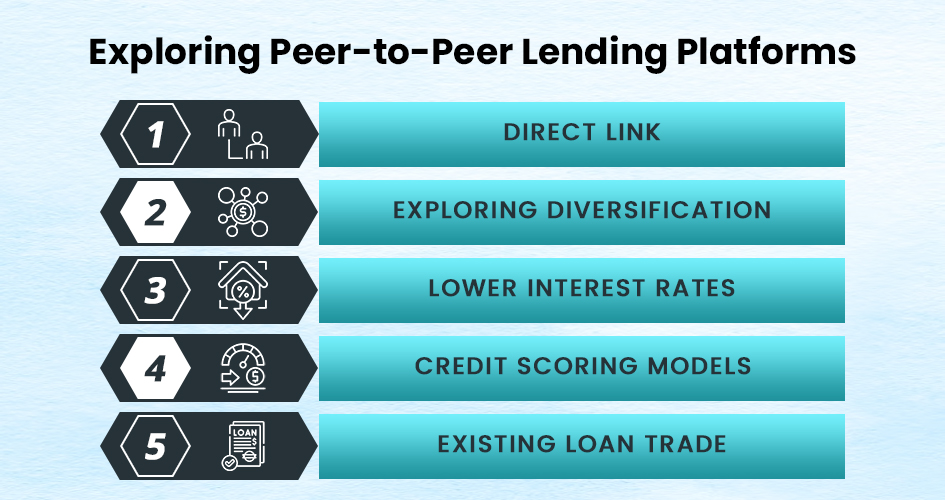

Direct Link: One of the main benefits of peer-to-peer lending platforms is the direct connection they create between borrowers and lenders. With peer-to-peer lending, borrowers can present their loan requests directly to potential lenders, bypassing traditional banking systems’ multiple layers of approval. This direct connection promotes openness and effectiveness in the lending process.

Exploring Diversification: Peer-to-peer lending platforms allow investors to expand their portfolios beyond the usual stocks and bonds. Investing in loans originated on these platforms will enable individuals to access a new asset class that offers attractive returns. For example, a savvy investor might allocate a portion of their portfolio towards consumer loans or small business loans available on a peer-to-peer lending platform.

Lower interest rates: Borrowers are often attracted to peer-to-peer lending platforms because they offer the potential for more favorable interest rates compared to traditional Banking institutions. Given these platforms’ streamlined operations, they are able to offer borrowers reduced interest rates by passing on the savings from lower overhead costs. This affordability makes peer-to-peer lending a compelling choice for individuals seeking personal loans or small businesses needing funding.

Credit scoring models: Peer-to-peer lending platforms utilize advanced algorithms and credit scoring models to evaluate borrowers’ creditworthiness. These models consider different factors such as income, employment history, credit score, and loan purpose to assess the level of risk associated with each borrower.

Existing loan trade: Certain peer-to-peer lending platforms provide a secondary market that enables investors to trade existing loans. This feature offers a convenient solution for investors needing to sell their investments before the loan term concludes. In addition, it enables lenders to expand their portfolios by investing in loans originated by other lenders on the platform.

How is peer-to-peer lending transforming Borrowing and Investing?

Peer-to-peer lending has become a significant disruptor in the borrowing and investing landscape, completely transforming Banking innovation. This revolutionary approach facilitates direct connections between borrowers and lenders via online platforms, bypassing the involvement of traditional intermediaries like banks or credit unions. Through eliminating intermediaries, peer-to-peer lending provides many advantages to borrowers and investors.

From a borrower’s perspective, peer-to-peer lending offers an alternative to traditional lending institutions with strict requirements and lengthy approval processes. This democratization of borrowing enables individuals who may not meet the stringent requirements of banks to obtain essential funds for various purposes, including debt consolidation, home improvements, or launching a small business. In addition, borrowers can get loans at competitive interest rates with those provided by conventional lenders.

The Advantages of Peer-to-Peer Lending for Borrowers

Peer-to-peer lending has revolutionized the Banking industry. It provides borrowers with a fresh alternative to conventional lending institutions. This cutting-edge approach facilitates the connection between individuals in need of loans and investors who are eager to lend money, eliminating intermediaries and establishing a lending process that is both streamlined and transparent. Peer-to-peer lending has numerous benefits for borrowers, making it an attractive option for those needing financing.

Lower interest rates: One key benefit of peer-to-peer lending is the potential for more favorable interest rates compared to traditional banks. Given the online nature of P2P platforms and streamlined operations, borrowers can benefit from competitive rates. It can be especially advantageous for individuals with excellent credit scores, who may be eligible for even more favorable rates.

Accessible funding: Peer-to-peer lending provides a viable alternative for borrowers who face challenges securing loans from conventional Banking institutions. Banking institutions frequently enforce stringent requirements and extensive approval procedures that may exclude individuals with less-than-ideal credit histories or non-traditional sources of income.

The Advantages of Peer-to-Peer Lending for Investors

Peer-to-peer lending has become a game-changer in traditional Banking innovation, giving investors a unique chance to broaden their portfolios and achieve higher returns. As investment bankers operate, peer-to-peer lending platforms facilitate direct connections between borrowers and individual investors, resulting in streamlined and transparent transactions.

Potential for Higher Returns: One of the appealing factors of peer-to-peer lending for investors is the possibility of achieving higher returns when compared to other investment options. By utilizing alternative lending channels, investors can earn interest rates that surpass those typically offered by traditional banks or government bonds.

Diversification: Investors can achieve diversification by allocating their investments across multiple loans through peer-to-peer lending. By spreading out their investments across various loans, investors can minimize the potential risk of a single borrower defaulting. This diversification strategy helps to minimize possible losses and offers a more stable investment platform.

Access to a Variety of Asset Classes: Peer-to-peer lending platforms allow investors to explore a diverse range of asset classes that may not be easily accessible through traditional investment channels. For example, specific platforms specialize in small business loans, while others focus on consumer or real estate financing. This variety enables investors to select the asset class that best suits their risk tolerance and investment objectives.

Transparency and Control: Peer-to-peer lending allows investors to have complete transparency and control over their investments. Unlike traditional investment methods, such as mutual funds, where fund managers make all the decisions, peer-to-peer lending allows investors to choose individual loans based on their preferences. Investors can carefully evaluate borrower profiles, credit scores, and loan details to make informed decisions about which loans to fund. This level of scrutiny allows investors to maintain a sense of control over their investment choices.

Passive income stream: Peer-to-peer lending allows investors to generate passive income. Once an investor has funded a loan, they can relax and receive regular interest payments without actively overseeing the investment. This passive income stream can be especially attractive for individuals seeking to supplement their current income or establish a consistent cash flow.

Challenges and risks of peer-to-peer lending

Peer-to-peer lending provides individuals with a fresh approach to borrowing and investing money. Although this innovative approach has gained popularity, “It has its challenges and risks.” Borrowers and lenders must be mindful of these pitfalls before participating in peer-to-peer lending.

One of the primary considerations in peer-to-peer lending is the credit risk associated with borrowers. Peer-to-peer platforms tend to attract borrowers who may need to meet traditional banks’ strict lending criteria. This raises the chances of default and presents a potential risk to lenders. For instance, lenders could incur Banking losses if a borrower cannot repay their loan.

Peer-to-peer lending operates in a less regulated space than traditional Banking institutions. Although this approach has advantages, it also has risks, such as the possibility of fraudulent or unethical behavior. Without adequate supervision, platform operators can engage in fraudulent activities or mismanage funds. Peer-to-peer lending platforms have experienced collapses as a result of fund misappropriation.

The reliability and stability of the platforms themselves are crucial for the success of peer-to-peer lending. Technical issues or system failures can disrupt the lending process, causing inconvenience for borrowers and lenders. In addition, if a platform ceases operations or closes without warning, it can result in substantial Banking setbacks for the individuals who have invested in it.

Conclusion

The future of peer-to-peer lending can significantly disrupt traditional Banking innovation. As the industry undergoes constant changes, new trends and innovations are emerging, transforming the way individuals and businesses access loans and invest their money. This section will delve into some of these exciting developments from different perspectives, illuminating the transformative potential of peer-to-peer lending.

The peer-to-peer lending revolution has undeniably caused a significant transformation in the Banking industry, shaking up traditional Banking innovation. Throughout this blog, we discussed how peer-to-peer lending platforms have entirely transformed how individuals and businesses can obtain funding, bypassing the need for traditional banks and intermediaries.

How Can Datavision help?

We assist various financial institutions and global banks on their digital transformation journey. Our one-of-a-kind approach, which combines people, process, and technology, expedites the delivery of superior results to our clients and drives excellence. Several reputed companies leverage our proprietary suite of business excellence tools and services to unlock new growth levers and unparalleled ROI.

Datavision stands proudly as a prominent banking software solutions provider, recognized for our unwavering commitment to excellence in the industry. We have earned our esteemed reputation by consistently delivering cutting-edge core banking software, catering to the needs of both retail and corporate banking software sectors. At Datavision, our mission is clear: to provide our clients with the best banking software products, ensuring that they stay ahead in an ever-evolving financial landscape. We take pride in serving our prestigious clients and look forward to continuing our journey of innovation and excellence.

Our portfolio of banking software product and services include:

Core Banking Solutions: | FinNext Core | Banking: | FinTrade | EasyLoan | MicroFin |

Digital Banking Solutions: | IBanc | MobiBanc | MBranch | FinTab | FinSight |

Risk & Compliance: |FinTrust |

Want to know how our team of experts at Datavision provides customizable, scalable, and cost-effective banking software products and solutions to our esteemed clients? Visit us for more information.