The Future of Mobile Banking: Trends and Predictions

Mobile banking, once a convenient add-on to traditional banking, has evolved into a comprehensive financial ecosystem. It now offers a wide range of services, from basic balance inquiries to advanced analytics, investments, and insurance. This transformation reflects the significant progress and the current state of mobile banking.

Today’s mobile banking apps are not just tools but financial ecosystems. They allow users to manage their entire financial lives, from budgeting and saving to investing and borrowing. Banks now compete on user experience and digital innovation, aiming to integrate every aspect of personal finance into a seamless app experience.

Why Mobile Banking is Essential Today

Why Mobile Banking is Essential Today

In today’s fast-paced digital world, managing finances on the go is not just a luxury, but a necessity. The convenience of accessing accounts anytime, anywhere, with just a few taps on a smartphone, has made mobile banking a lifeline for busy professionals, remote workers, and anyone who values time and efficiency.

Moreover, the COVID-19 pandemic accelerated the shift toward digital banking. With lockdowns restricting physical branch visits, mobile banking became the primary mode of interaction between banks and their customers.

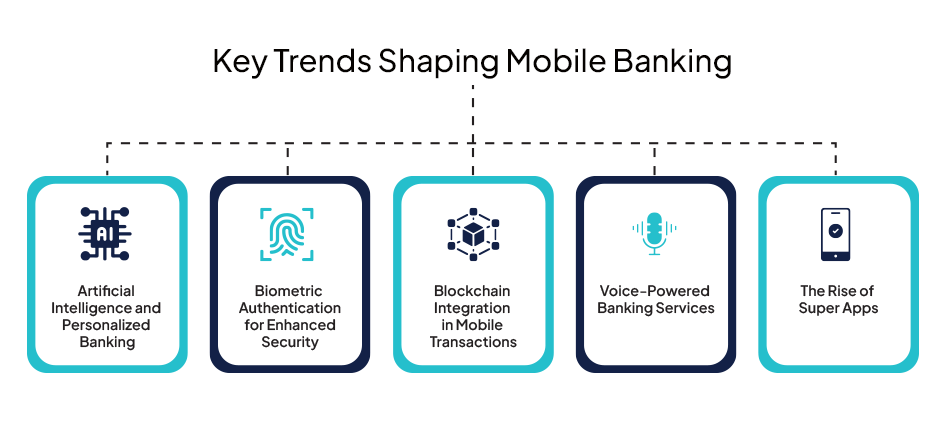

Key Trends Shaping Mobile Banking

Banks also use AI to detect fraudulent activities. Advanced machine learning algorithms monitor transaction patterns and flag unusual activities, enhancing the safety of users’ accounts.

Biometric authentication ensures that only authorized users access sensitive information, making it essential to combating fraud and identity theft.

Additionally, blockchain enhances the security of mobile transactions. With every transaction recorded on an immutable ledger, the risk of fraud is minimized. This technology is particularly promising for cross-border payments, where traditional methods often involve delays and high fees.

From checking balances to making transactions, voice commands are adding a layer of convenience that aligns perfectly with the busy lifestyles of today’s users.

The success of super apps in regions like Asia has inspired global financial institutions to explore similar models. By integrating diverse functionalities, banks can keep users engaged while offering unmatched convenience.

The Role of Financial Inclusion in Mobile Banking

Reaching the Unbanked Populations

Reaching the Unbanked Populations

According to the World Bank, over 1.4 billion adults remain unbanked globally. Mobile banking is a game-changer for these populations, offering a lifeline of financial services. With just a smartphone, people in remote areas can access previously inaccessible financial services, fostering financial inclusion and empowerment.

Mobile banking apps designed for low-income users focus on simplicity and affordability. They often require minimal documentation, making them accessible to people without formal identification or credit histories.

Microfinance Opportunities via Mobile Platforms

Microfinance Opportunities via Mobile Platforms

Microfinance has gained significant traction through mobile platforms. These apps enable small-scale entrepreneurs and farmers to access microloans, helping them grow their businesses. For example, in many African countries, mobile banking services like M-Pesa have revolutionized access to microfinance.

By offering tailored financial solutions, mobile platforms empower individuals and small businesses to achieve economic stability and growth.

Predictions for the Future of Mobile Banking

Increased Integration with IoT

Increased Integration with IoT

The Internet of Things (IoT) is set to revolutionize mobile banking, opening up a world of possibilities. Connected devices, from wearables to smart home appliances, will enable seamless financial transactions. Imagine your smartwatch alerting you about bill payments or your car automatically paying for fuel at a gas station. This is just the beginning of a future where banking becomes an invisible yet integral part of daily life.

IoT will blur the lines between technology and finance, making banking an invisible yet integral part of daily life.

Real-Time Payments Revolution

Real-Time Payments Revolution

Real-time payment systems are poised to become the standard. These systems allow instantaneous fund transfers, eliminating the delays associated with traditional banking. With growing demand for speed and efficiency, real-time payments will redefine how people and businesses handle money.

Expanding Role of Digital Wallets

Expanding Role of Digital Wallets

Digital wallets like Datavision’s very own DV Pay, PayPal, Apple Pay, and Google Wallet are already popular, but their role will expand. As more merchants and consumers adopt digital wallets, they will become the preferred mode of payment for online and offline transactions.

These wallets also integrate loyalty programs, making them an attractive option for consumers looking to save while they spend.

Sustainable Banking through Mobile Platforms

Sustainable Banking through Mobile Platforms

Sustainability is becoming a priority for banks and consumers alike. Mobile banking apps can lead the way in promoting eco-friendly practices. These platforms, from paperless statements to carbon footprint trackers, will help users make environmentally conscious financial decisions.

Challenges Ahead in Mobile Banking

Cybersecurity Threats

Cybersecurity Threats

As mobile banking becomes more advanced, so do the threats. Cyberattacks, data breaches, and phishing scams pose significant risks. Banks must continually invest in cutting-edge security technologies to protect their users.

Regulatory Hurdles Across Borders

Regulatory Hurdles Across Borders

Global mobile banking faces challenges in harmonizing regulations. Different countries have varying compliance requirements, making it difficult for banks to offer seamless cross-border services. Addressing these regulatory discrepancies will be crucial for global adoption.

Maintaining User Trust Amidst Technological Advances

Maintaining User Trust Amidst Technological Advances

While innovation is exciting, it can also be intimidating. Users need assurance that their data is safe and their money is secure. Banks must focus on transparency and education to maintain trust while introducing new technologies.

Conclusion

The future of mobile banking is brighter than ever. With trends like AI, blockchain, and IoT shaping its evolution, mobile banking is set to become more accessible, secure, and efficient. However, navigating challenges like cybersecurity and regulatory compliance will be key to unlocking its full potential.

As technology continues to evolve, mobile banking is likely to become an indispensable part of everyday life, offering users convenience and empowering them to make smarter financial decisions. The financial world is witnessing a profound transformation, and the opportunities for innovation are limitless. Whether it’s reaching the unbanked, enabling microfinance, or delivering hyper-personalized services, mobile banking stands as a beacon of the future of finance.

FAQs

How Can Datavision help?

We assist various financial institutions and global banks on their digital transformation journey. Our one-of-a-kind approach, which combines people, process, and technology, expedites the delivery of superior results to our clients and drives excellence. Several reputed companies leverage our proprietary suite of business excellence tools and services to unlock new growth levers and unparalleled ROI.

Datavision stands proudly as a prominent banking software solutions provider, recognized for our unwavering commitment to excellence in the industry. We have earned our esteemed reputation by consistently delivering cutting-edge core banking software, catering to the needs of both retail and corporate banking software sectors. At Datavision, our mission is clear: to provide our clients with the best banking software products, ensuring that they stay ahead in an ever-evolving financial landscape. We take pride in serving our prestigious clients and look forward to continuing our journey of innovation and excellence.

Our portfolio of banking software product and services include:

Core Banking Solutions: | FinNext Core | Banking: | FinTrade | EasyLoan | MicroFin |

Digital Banking Solutions: | IBanc | MobiBanc | MBranch | FinTab | FinSight |

Risk & Compliance: |FinTrust |

Want to know how our team of experts at Datavision provides customizable, scalable, and cost-effective banking software products and solutions to our esteemed clients? Visit us for more information.