Introduction

In today’s digital landscape, where technological advancements continue to reshape the way we interact with businesses, the importance of good user experience (UX) cannot be emphasized enough, especially for financial institutions. While traditionally, banks and other financial entities may have yet to place a strong emphasis on customer-centric experiences, the digital revolution has altered this paradigm significantly. This comprehensive analysis delves into the reasons why user experience is of paramount importance for financial institutions, highlighting its impact on customer satisfaction, brand loyalty, and overall business success.

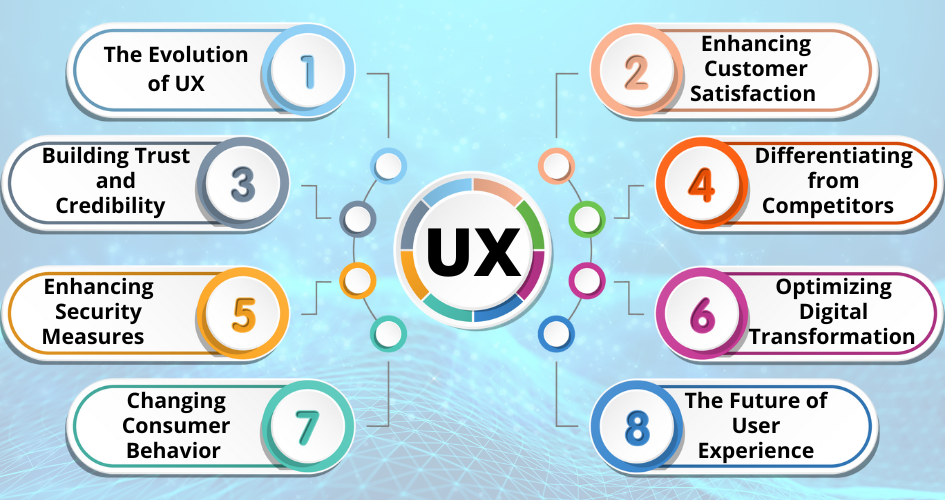

The Evolution of User Experience in Financial Institutions

The concept of user experience in the context of financial institutions has evolved significantly in recent years. Historically, the industry primarily focused on security and reliability, often at the expense of customer convenience and ease of use. However, with the rise of digital banking, mobile applications, and online financial services, users expect seamless, intuitive, and personalized experiences from their financial service providers. This shift in user expectations has compelled financial institutions to reevaluate their strategies and prioritize user experience to remain competitive in the modern marketplace.

Enhancing Customer Satisfaction and Loyalty

One of the critical benefits of prioritizing user experience for financial institutions is the potential to enhance customer satisfaction and loyalty significantly. By offering user-friendly interfaces, intuitive navigation, and streamlined processes, institutions can create a positive and hassle-free experience for their customers. A smooth and efficient user experience fosters trust and confidence in the institution, increasing customer satisfaction and a higher likelihood of customer retention. Satisfied customers are more inclined to continue using the institution’s services, fostering long-term loyalty and positive word-of-mouth recommendations.

Enhancing Customer Satisfaction and Loyalty

One of the critical benefits of prioritizing user experience for financial institutions is the potential to enhance customer satisfaction and loyalty significantly. By offering user-friendly interfaces, intuitive navigation, and streamlined processes, institutions can create a positive and hassle-free experience for their customers. A smooth and efficient user experience fosters trust and confidence in the institution, increasing customer satisfaction and a higher likelihood of customer retention. Satisfied customers are more inclined to continue using the institution’s services, fostering long-term loyalty and positive word-of-mouth recommendations.

Differentiating from Competitors

In an increasingly competitive market, where numerous financial institutions vie for customers’ attention, providing an exceptional user experience can be a powerful differentiator. A well-designed and user-friendly interface can set an institution apart from its competitors, positioning it as a customer-centric organization that delivers seamless and convenient financial services. By offering unique features, personalized recommendations, and tailored solutions, financial institutions can distinguish themselves in the market, attracting and retaining customers who prioritize a superior user experience.

Enhancing Security Measures

While focusing on user experience, financial institutions must also prioritize robust security measures to protect customers’ sensitive financial information. Balancing user-friendly interfaces with stringent security protocols is essential to instill customer confidence and mitigate potential security risks. Implementing multi-factor authentication, encryption techniques, and regular security updates alongside an intuitive user interface can create a secure yet user-friendly environment, assuring customers of the institution’s commitment to safeguarding their financial assets and data.

Optimizing Digital Transformation

In today’s business landscape, it has become essential to undergo a digital transformation in financial services. Let me know if you need any further assistance. By prioritizing user experience, financial institutions can streamline and optimize their digital transformation efforts, ensuring a seamless transition from traditional banking to digital platforms. Investing in mobile apps, online banking portals, and customer support caters to tech-savvy customers, positioning banks as digital pioneers.

Adapting to Changing Consumer Behavior

Consumer behavior within the financial sector has shifted significantly in recent years, with an increasing preference for digital transactions and remote banking services. Financial institutions must prioritize user experience to meet evolving customer demands. By offering personalized financial recommendations, facilitating easy account management, and providing real-time customer support, institutions can align their services with the expectations of digitally savvy consumers, thereby ensuring sustained relevance and competitiveness in the market.

The Future of User Experience in Financial Institutions

Looking ahead, the future of user experience in financial institutions will continue to revolve around technological innovation, personalization, and the seamless integration of digital services. Artificial Intelligence, Machine Learning, and Data Analytics can enhance user experiences, provide customized financial solutions, and accurately predict customer requirements. Financial institutions that focus on continuous technological advancements, user-centric design, and proactive customer engagement strategies will undoubtedly lead the way in shaping the future of the financial services industry.

Conclusion

In today’s digital era, providing an exceptional user experience has become a crucial aspect of success and longevity for financial institutions. By giving utmost importance to creating a seamless, secure, and user-friendly experience, institutions can improve customer satisfaction, establish trust and credibility, stand out from competitors, and keep up with the ever-changing demands of their clientele. With the relentless advancement of technology and the growing significance of digital transformation, financial institutions must remain committed to delivering exceptional user experiences to maintain their competitive edge and foster long-term growth and success.

FAQs (Frequently Asked Questions)

Q1: Why is user experience crucial for financial institutions?

A: User experience is crucial for financial institutions as it directly impacts customer satisfaction, brand loyalty, trust, and differentiation in a competitive market. A seamless, secure, user-friendly experience enhances customer retention and fosters a positive brand image.

Q2: How does prioritizing user experience help build trust and credibility for financial institutions?

A: Prioritizing user experience helps build trust and credibility by ensuring customers easily navigate digital platforms, complete transactions securely, and access relevant information effortlessly. A user-centric approach instills confidence in the institution’s capabilities and security measures, enhancing customer trust and loyalty.

Q3: What role does user experience play in the digital transformation of financial institutions?

A: UX plays a pivotal role in the digital transformation of financial institutions by facilitating a seamless transition from traditional banking to digital platforms. By investing in mobile apps, online banking portals, and customer support, institutions cater to the needs of tech-savvy customers, positioning themselves as pioneers in the digital banking landscape.

Q4: How can financial institutions adapt to changing consumer behavior through user experience?

A: Financial institutions can adapt to changing consumer behavior by prioritizing user experience and offering personalized financial recommendations, easy account management, and real-time customer support. By aligning their services with the expectations of digitally savvy consumers, institutions can ensure sustained relevance and competitiveness in the market.

Q5: What does the future of user experience in financial institutions entail?

A: The future of user experience in financial institutions will revolve around technological innovation, personalization, and the seamless integration of digital services. AI, Machine Learning, and Data Analytics will play a significant role in enhancing user experiences, providing customized financial solutions, and predicting customer requirements accurately. Institutions that focus on continuous technological advancements and proactive customer engagement strategies will lead the way in shaping the future of the financial services industry.

How Can Datavision help?

We assist various financial institutions and global banks on their digital transformation journey. Our one-of-a-kind approach, which combines people, process, and technology, expedites the delivery of superior results to our clients and drives excellence. Several reputed companies leverage our proprietary suite of business excellence tools and services to unlock new growth levers and unparalleled ROI.

Datavision stands proudly as a prominent banking software solutions provider, recognized for our unwavering commitment to excellence in the industry. We have earned our esteemed reputation by consistently delivering cutting-edge core banking software, catering to the needs of both retail and corporate banking software sectors. At Datavision, our mission is clear: to provide our clients with the best banking software products, ensuring that they stay ahead in an ever-evolving financial landscape. We take pride in serving our prestigious clients and look forward to continuing our journey of innovation and excellence.

Our portfolio of banking software product and services include:

Core Banking Solutions: | FinNext Core | Banking: | FinTrade | EasyLoan | MicroFin |

Digital Banking Solutions: | IBanc | MobiBanc | MBranch | FinTab | FinSight |

Risk & Compliance: |FinTrust |

Want to know how our team of experts at Datavision provides customizable, scalable, and cost-effective banking software products and solutions to our esteemed clients? Visit us for more information.